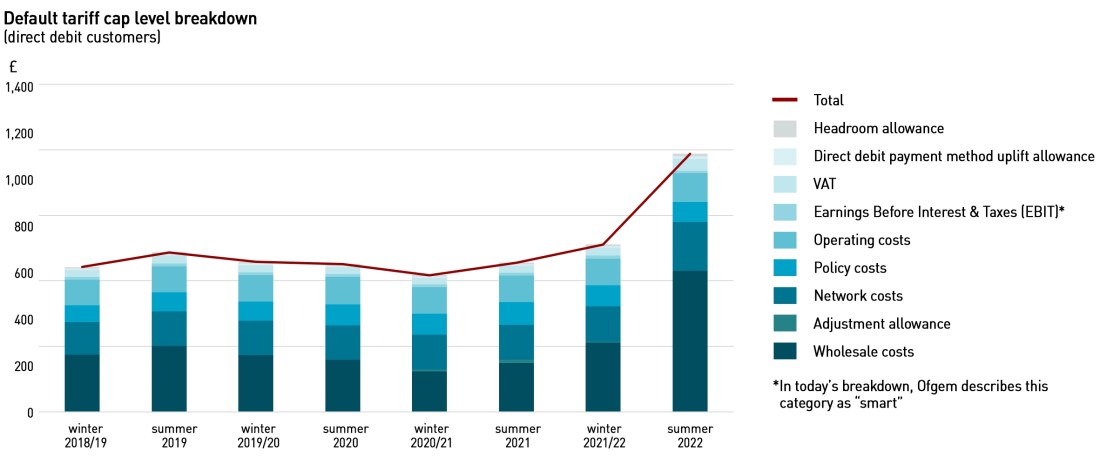

This morning Ofgem has announced a record increase in the level of the default tariff price cap, from £1,277 now to £ 1,971 from 1 April, an increase of 54%. About 80% of this rise is a result of increases to wholesale gas and electricity prices which have more than quadrupled in the past year. Many now expect the cap to rise above £2,000 in October (or perhaps earlier, since Ofgem has been consulting on increasing the frequency of cap adjustments).

“Under the price cap mechanism, energy companies will be allowed to pass on these higher costs from April when the new level takes effect. This is because energy companies cannot afford to supply electricity and gas to their customers for less than they have paid for it,”

– Ofgem

The rise has been widely expected, but what was not expected until it was first reported by The Times yesterday, was that the Government would soften the blow by providing almost every household in the country with a price-cap subsidy to the tune of £350.

“The impact of soaring gas prices has so far fallen predominantly on energy companies, so much so that some suppliers who couldn’t afford to meet those extra costs have gone out of business as a result. It is not sustainable to keep holding the price of energy artificially low,”

– Rishi Sunak, Chancellor of the Exchequer

This £350 subsidy will affect 28 million households, and will be delievered in 3 ways:

- All domestic electricity customers will receive an upfront discount worth £200 on their bills, which will be applied by energy suppliers from October with the Government meeting these costs in full. These amounts will be repaid through bills with a flat £40 charge over the next 5 years;

- A £150 council tax rebate will be provided to all households in bands A-D, benefitting around 80% of households from April. This rebate will not need to be repaid, and is deliberately not just supporting those on benefits since many on middle incomes also struggling with high energy prices;

- Local authorities will be given discretionary funds of up to £150 million to help low income households that live in higher council tax properties and those who are exempt from council tax and would not benefit from the rebate.

Other measures announced incude:

- Eligibility for the Warm Homes Discount will be expanded by almost a third so more people benefit – bringing the total number of households in the scheme to around 3 million;

- £3 billion will be invested over this Parliament to make low income homes more energy efficient saving them on average £290 /yr on energy bills, which will affect more than 0.5 million homes.

A VAT cut was ruled out on the basis it would disproportionately benefit better-off households and there would be no guarantee that suppliers would pass it on. The Chancellor believes this would become a permanent subsidy, although energy is already subsidised, since it is taxed at 5% and not the typical VAT level of 20%.

As always, the devil will be in the detail. The Chancellor said the Government will meet the cost of the £200 electricity bill discount “in full” – presumably this includes the financing costs, so it will be interesting to see how this will be structured. The speculation yesterday was that the Government would provide loans to suppliers – and this may well still be the plan – but it would need to be done in a way that did not negatively impact the credit profiles of suppliers, or any debt covenants they may have in bank loans and so on. It was also unclear when the £40 repayments would begin.

The question now is whether these one-off measures will be enough, and whether gas prices will fall, providing relief for consumers.

Gas prices are likely to remain high for longer than expected

There is a widespread expectation that the price cap will increase again in October with some commentators suggesting there may be little scope for reductions over the next 18-24 months. European gas prices may well be boosted by increased demand as various countries move away from coal, with Germany and Belgium also closing significant nuclear capacity.

“There’s no reason to think energy prices will come down anytime soon. The market suggests high gas prices will be here for the next 18 months to two years. As you turn off coal-fired power stations in other countries, they develop more demand for gas — but there is not an abundance of gas you can just turn on,”

– Chris O’Shea, CEO, Centrica

The gas and electricity forward curves for the UK have changed shape significantly over the past couple of months, with near-term contracts falling in value while prices for delivery next winter have risen significantly. The market is no longer expecting a normalisation of gas prices in the latter part of this year.

After peaking in December, European gas prices have fallen on the back of warmer weather, higher LNG imports and reduced competition from Asia, where gas stocks have been sufficient this winter. So far, the weather in Europe (unlike Russia) has been mild, although there is still scope for colder weather, as well as geopolitical tensions over Ukraine, to push prices higher. Goldman Sachs Commodities Research said in a recent research note that if tensions between Russia and Ukraine escalate, “the initial uncertainty around its impact on gas flows would likely lead the market to once again add a significant risk premium” to European gas prices.

But storage levels remain below historic norms, and are at the point they would typically be in early March. Analysts at Goldman Sachs suggest that it will take more than just higher LNG imports to balance inventories this summer, and the market is likely to remain tight into next winter and beyond, possibly for another three years. Restoring the storage balance is likely to rely on higher flows of Russian gas.

“As we near February, approaching the end of the heating season in the Northern Hemisphere, it’s tempting to think that the European energy crisis is over, especially with record-high inflows of LNG from Asia into Europe. We view such a take as premature. This is not only because near-term risks to European gas supplies persist, but also because the uncertainty around European gas supplies extends through the coming summer – and likely through 2025. This means that, while not our base case, the tightness in European gas balances that drove prices to historic levels late last year to drive industrial demand destruction might repeat itself over the next few years,”

– Goldman Sachs

“Without additional Russian imports, the ability to refill depleted storage and to avoid a repeat of last year’s crisis will be limited. But Gazprom has so far been reluctant to make more gas available on the existing routes. And the start-up of Nord Stream 2 remains the big unknown as Gazprom navigates regulatory approvals…

Cold weather in Europe could exacerbate the situation further, adding up to 10 bcm to gas demand through the rest of the winter, pushing storage levels to zero unless more Russian gas is supplied, and Europe may have to tap into cushion gas to balance the market. Normal winter weather, including in Asia, and visibility on Nord Stream 2 commissioning would push prices down, although demand for storage (and high carbon costs) will maintain prices above US$ 15 /mmbtu,”

– Kateryna Filippenko, principal analyst, European gas research at Wood Mackenzie

Europe is now strongly dependent on imports. European production (EU and UK) only contributes 12% of total gas supplies, with pipeline imports representing 65%, and LNG imports 18%. In 2021, 1.4% of gas was sourced from storage facilities, ie there was a net withdrawal over the year (data relate to the period from 1 January – 30 November 2021). The final figures for the year may look a little different: LNG imports were broadly similar to the monthly average for the first 11 months of the year, but pipeline imports, particularly from Russia, fell due to high hub prices. Indeed there were gas flows from west to east as Eastern European countries were supplied from countries to their west, rather than from Russia, with reverse flows on the Yamal-Europe pipeline from 21 December until yesterday when flows fell to zero.

LNG imports for the beginning of 2022 have jumped significantly as high prices attracted cargoes away from Asia – Kpler analyst Laura Page told NGI that LNG arrivals were expected to reach a record 11.4 Mt in January, up from 8.7 Mt in December and well above the previous record of 9.7 Mt in March 2020.. The picture in the UK is somewhat different with 48% of gas consumed in the country coming from domestic production, 30% from pipeline gas imports and 22% from LNG imports.

While Gazprom produced record volumes of gas in 2021, its exports to Europe, while meeting all contractual obligations, fell short of expectations by the end of the year, as high prices in December reduced nominations by European buyers. Cold weather in Russia at the end of the year saw supplies to domestic consumers reaching 1.656 bcm/day, higher than Gazprom’s average daily production levels for December. To meet this demand, withdrawals from local underground storage reached five-year highs.

Other factors are set to support higher end-user energy prices

Wholesale gas prices are not the only driver for rising end-user prices, and the price cap level. Network costs have also risen significantly (by 39%) as SOLR costs are recovered through network charges. In December, Ofgem approved an initial £1.83 billion representing the wholesale price component of SOLR costs. Costs relating to credit balances, and the wider costs of the Bulb collapse are not included in this amount and will be recovered in the future, putting further pressure on bills.

The actual costs of building and operating networks are also rising year-on-year, reflecting the costs of developing new infrastructure to accommodate generation that is located in new areas, and the higher costs of balancing a system with growing levels of intermittent generation and falling inertia.

Capacity market costs have been rising and are set to rise further. Winter capacity margins in GB are falling, and this is likely to boost the capacity market requirements and the auction prices, the costs of which are also recovered through energy bills. The rising costs of renewable subsidies are also recovered through bills, as more and more assets are subsidised, albeit at declining price levels. There is also the subsidy impact of the failed suppliers to consider, which pushed last year’s Renewables Obligation mutualisation to a record £218 million.

Price cap subsidy just adds complexity and fails to address the fundamental problems with the market

While the price cap subsidy will provide some relief to households struggling with a wider increase in the cost of living, it further complicates and distorts the already dysfunctional supply market. We will need to wait for the full details of the £200 discount to understand its full impact, but if it ends up being a loan, then Ofgem will need to find a way to ensure that new entrants who are not subject to this scheme cannot unfairly undercut existing suppliers by pricing below the cap level if wholesale prices fall. The regulator has time to think about this since wholesale prices are not now expected to adjust for some time, and is already looking at other impacts legacy suppliers will face as a result of last year’s multiple SOLRs. But every measure adds further complexity and further distortions to the market.

So I repeat my calls for wider market reforms – jumping through these convoluted hoops to avoid doing what really should be done – abolishing the cap altogether – is a purely political gambit, and sooner or later consumersand voters will see through it.

My recommendations for the supply market remain as they have been for some time:

- Remove the cap

- Remove green levies (and provide temporary VAT relief to households)

- Remove the ECO, WHD and smart meter obligations from suppliers, moving them to more suitable agencies

- More retail regulation to the Financial Conduct Authority

- Re-set the relationship between BEIS, Ofgem and suppliers to restore trust in the sector

And more broadly, the Government needs to secure strategic gas supplies by entering into firm, long-term purchase contracts with gas producing nations, and it should pro-actively ensure that the UK’s domestic gas resources, whether in the North Sea or as shale gas, are fully exploited. At the same time, consideration should be given to re-opening Rough to provide meaningful seasonal storage capacity (or indeed developing another depleted gas field for this purpose). If we are moving into a period of sustained higher prices, steps must be taken to increase the resilience of our energy system. Adding price cap subsidies to the wide range of generation subsidies moves price support into both ends of the value chain. It’s past time for a major re-think.

Another great insight into the background to the increase. Basically they are lending me £200 which i pay back over following five years. Not eligible for 150. Good to see them raising insulation again but it shouldn’t have taken this to do it.

Personally i feel prices will drop back from here and significantly if Ukraine crisis unwinds.

I agree, this is basically a loan that has to be paid back, although it’s interest-freee for consumers so there is some benefit.

I think on insulation there needs to be a much more cohesive policy involving an actual roadmap and milestones. Local authorities need to be tasked with a defined programme to upgrade homes, starting with repairs through to replacement of windows and doors, insulation and eventually low carbon heating systems.

The schemes need to have defined targets, with measurable outcomes in terms of both work done (x number of properties with repairs carried out) as well as outcomes (which reduced measured heat losses by y amount on average per home). Too many of these initiatives lack the practical roadmaps necessary for actual reductions in energy costs at the household level to be realised at scale.

On gas…I would expect Ukraine to be impacting the front of the curve more than the back, so I’m not really sure that prices a year out would adjust that much if Russian soldiers returned to barracks. Hopefully we’ll get to find out soon….

£3bn for 0.5 million homes is £6,000 apiece to save £290 – on an unspecified basis of calculation, and probably to appear as a £3bn Ecohomes charge on consumer bills. It’s over a 20 year payback, and in my book not a worthwhile investment. Spend the money on direct bill cuts instead and you could knock £290 of 10 million bills immediately, and I’ll keep the change…. Of course we know from scheme after scheme that real world performance is way behind the grandiose claims made when they are proposed. You are right that we desperately need to have a properly audited way of doing things – and a willingness to recognise that many projects have too poor a payback to be undertaken. We should be concentrating on the ones with short paybacks, and be prepared to find other ways to help where savings can’t be made economically. The best help is finding ways to lower energy costs. There has been no attempt at all to do that – utterly shameful. Defer ROCs. Stop uneconomic Ecohomes spending. Halt smart meter rollout so we don’t have to write off yet more meters in a couple of years because the next ones will be even smarter and use a different phone network. Slash carbon tax that only drives up prices. Burn more coal. Keep our coal capacity for now. All ways of lowering costs immediately, and none of them attempted. Add in the longer term measures that might help to calm market nerves, such as supporting more oil and gas development, going for a sensible nuclear policy with proven technology and much faster rollout than 1 EPR at Sizewell and maybe some SMRs in 15 years. The only thing that is difficult is the zero goggles worn by Kwarteng and Boris.

I am being forced into a buy now pay later loan administered by my supplier whose probity I question and some of my electricity will be subsidised through the already obscure council tax mechanism. How will I know what my electricity is actually costing?

OFGEM are considering revising the cap every six months or even three months to better deal with gas price volatility. Perhaps it should be revised weekly or daily. What is the logic in this. I though the whole purpose was the give the customer some stability.

OFGEM say the long term solution is to have a more diverse mix of generation sources with which I totally agree but then reveal their biased agenda by saying this should be by increasing renewables.

Looking at the OFGEM info https://www.ofgem.gov.uk/check-if-energy-price-cap-affects-you

I see that the cap on standing charge for electricity is being increased from 0.25p/day to 0.45p/day thats 80% is this the way of recovering the SOLR impact.

On gas its hardly changing from 26 to 27p/day.

For completeness energy charge cap is 21p to 28p/kwh for electricity and 4p to 7p/kwh for gas.

QE was used by BoE to rescue our high-street banks from failure a decade ago

The energy market is also too big to fail: certainly, one can forecast GDP which would result from zero kWh resulting from rolling black-outs (it’s zero)

The government could use a similar arrangement to save all (domestic, commercial, industrial) customers with the additional energy costs wrapped up in a ‘bad bank’.