Last week Centrica announced its interim results, which saw British Gas profits increase tenfold, setting off predictable outrage from the media and politicians. Journalists have been falling over themselves to criticise the company, and in particular the fact that much of this “windfall” is being paid out to shareholders. There is no mention of the fact that Centrica previously cancelled its final 2019 dividend payment and made no payouts to shareholders in 2020 – this is forgotten in the current hysteria.

How much money has British Gas actually made?

In the six months to 30 June 2023, British Gas made an operating profit (EBIT) of £969 million, compared with £98 million the year before, on revenues of £11,889 million (versus £5,090 million in H1 22). This means an operating margin of 8.2% in H1 23 (1.9% H1 22). EBITDA margins for British Gas were 8.3% in H1 2023 and 2.7% in H1 2022.

This might sound generous, but when compared with other top UK companies, it is quite poor. An analysis of EBITDA margins of the FTSE-100 companies (from Bloomberg) provides interesting reading. For some reason, values were not returned for 17 companies (the data set is large enough to make hunting through their actual accounts an exercise of minimal benefit), so this analysis relates to the other 83 companies in the UK’s leading share index. Despite earning “high” returns on its upstream business in 2022, Centria’s EBITDA margin (earnings before interest, tax, depreciation and amortisation as a percentage of revenues) was 1.4% and the company ranked 78th out of 83. BP was not much better, coming in 65th although its EBITDA margin was a much more respectable 11.9%. The top five performers were 3i Group (85%), Rightmove (74%), UNITE Group (63%), Vodafone (60%) and Auto Trader (58%).

An EBITDA margin of 8.3% last year would have put Centrica in 71st rather than 83rd place out of the 87 companies whose results were available on Bloomberg. Hardly a sign of egregious profiteering.

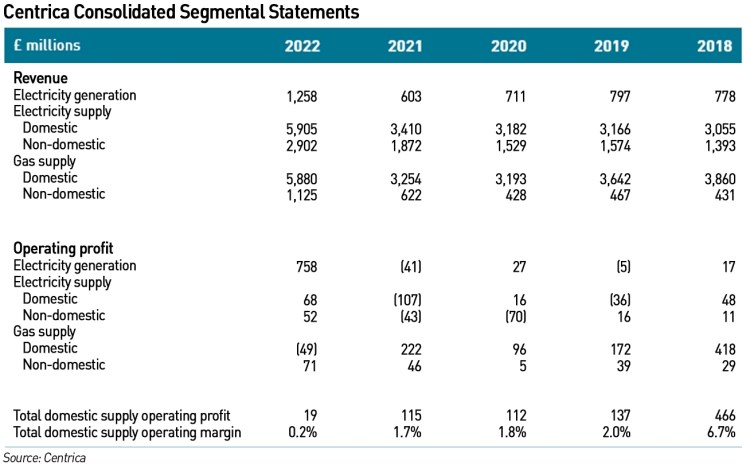

That is all based on the statutory presentation of results. It is also interesting to consider Centrica’s Consolidated Segmental Statement (“CSS”), an Ofgem requirement which shows the performance of Centrica’s licenced businesses, separated out by domestic and non-domestic customers. As can be seen from the chart below, in the profitability of the domestic supply business has been consistently poor since 2018, before the introduction of the price cap (and even then the performance was hardly stellar).

Profit margins below 2% cannot be considered “excess”, and companies earning 2% operating profit margins cannot be said to be profiteering. The GB domestic supply business is fundamentally a low-margin business, and while Centrica is probably one of the better performing suppliers in terms of profitability – there are likely to be economies of scale – these are still very low levels of profitability and in 2022 the business barely broke even. In two of the past five years the domestic electricity supply business was loss-making and last year the domestic gas supply business made a loss.

British Gas profits explained

£500 million of the £969 million of operating profit made by British Gas in the first half of this year related to backward-looking allowances in the price cap, and is due to Ofgem allowing suppliers to recover costs they were prevented from charging when wholesale prices surged in excess of the price cap in late 2021 and following the invasion of Ukraine in February 2022. As the price cap was only adjusted every six months, and as higher than expected numbers of customers went onto the capped default tariff since this became the cheapest tariff in the market, suppliers were forced to buy gas and electricity in the wholesale markets above the cap level, leading to significant losses. In H1 2022, British Gas incurred additional costs of £250 million as a result.

Ofgem recognised that suppliers should not be penalised for this situation – in normal market conditions, suppliers are entitled to recover the full wholesale cost of buying the gas and electricity they sell to their customers, but the delays in adjusting the price cap meant, this was not always possible. Ofgem allowed suppliers to recover some of these costs starting from April 2022 and continuing into this year. So this “profit” now is not really profit, it is essentially delayed revenue: had the price cap been adjusted more frequently, suppliers would have been able to recover these costs at the time they were incurred, but since that was not possible, it has been done retrospectively.

This adjustment will not affect the next accounting period, and Centrica expects profits at British Gas for the whole of 2023 to be heavily weighted to the first half of the year. However, from October it will benefit from the higher EBIT allowance under the price cap.

From October this year, Ofgem is increasing the EBIT allowance in the price cap from 1.9% to 2.4%, in recognition of the fact that 1.9% is simply too low to encourage the innovation it wants to see in the sector, and also to allow suppliers to improve their financial resilience, something that is difficult to do in a low-margin environment. Low margins mean even well run businesses have little scope for building reserves (absent other, non-supply business lines), meaning they are more likely to fail in times of market instability. Indeed, half of the suppliers in the market did exactly that in late 2021, adding £ billions to consumer bills in the form of Supplier of Last Resort costs. Ofgem would like suppliers to build more of a financial cushion to guard against future mass failures, but this will only be possible if they can recover previous losses and earn higher margins.

British Gas has managed to perform broadly in line with the EBIT allowance since its introduction, in its domestic supply business (which is the only area affected by the cap), except in 2022.

The duties of company directors do not include a “moral obligation” to help alleviate poverty

Company directors have various statutory duties set out in the Companies Act 2006. The most well known of these is that of “promoting the success of the company”, which is described by the government as follows:

“The duty states a director must act in a way that they consider, in good faith, would be most likely to promote the success of the company for the benefit of its members (shareholders) as a whole. When making decisions, directors must also consider the likely consequences for various stakeholders, including employees, suppliers, customers and communities. They should also consider the impact on the environment, the reputation of the company, company success in the longer term and all of the shareholders (including minority shareholders).”

While other stakeholders such as customers are mentioned, it is clear that the primary duty of company directors is to their shareholders. It is not the job of private companies to alleviate poverty or provide any other type of social benefit, beyond what is necessary for the long-term good of the company and its profitability. I was recently asked by a radio producer whether I agreed that energy companies had a “moral obligation” to “do something” about the “cost of living crisis”. Of course my answer was an emphatic “no” – it is the responsibility of governments to mitigate the effects of high energy costs, and as long as energy companies are conducting themselves in accordance with the law and their regulatory duties, not only do they not have wider societal obligations, company directors might be in breach of their statutory duties if they tried to do so.

Taking the example of Centrica. This is a FTSE-100 listed company, and as such its shares are widely held by pension funds, index-tracking ISAs, and other common financial products held by ordinary people as opposed to wealthy individuals or professional investors. Any actions to use part of Centrica’s profits to “help” with the cost of living crisis would in practice mean reducing dividends, and a drop in the share price, since value would leave the company for stakeholders other than its shareholders. Those shareholders, some of whom are ordinary pensioners, would have a legitimate grievance against the company were this to happen. It would also have other adverse market impacts as I described here.

Another recent example is BP, another FTSE-100 company, but whose operations are largely outside the UK. BP also does not sell gas or electricity to British households. So accusations that it is profiteering at the expense of “ordinary, hard-working people” are false. If BP were to “do something” in relation to fuel poverty, it would most likely do so in proportion to its global operations, and as only 7% of its revenues were generated in the UK last year, that would be minimal.

Jeremy Hunt, the Chancellor of the Exchequer, said that companies reporting strong profits must “tell us what they’re doing to keep the cost of living down for their customers”. However, it would not be unreasonable for these companies to respond by asking “why should we?” While being sympathetic to the pressures faced by householders in the context of high energy and food prices, the answer to these challenges is not for individual companies to take arbitrary actions. It is the job of the government, and Chancellor Jeremy Hunt specifically, to assist households with the cost of living.

We live in a capitalist society, in which the entire purpose of companies is to make profits for shareholders – that is why companies exist in the first place. Organisations that want to help people and are not interested in profits are called “not-for-profit” organisations or charities, and in those cases, different duties apply to their directors. But commercial companies exist for the benefit of their shareholders, and that benefit is represented by profits. Of course, there are well-rehearsed tensions relating to short-term versus long-term profits and business sustainability – but the law is clear that directors are expected to take a long-term view.

In some cases, companies might choose to engage in actions that reduce profits in the short-term in the hope of a longer-term benefit, or to avoid a detriment. For example, British Gas has two hardship funds, one for its own customers and one for customers of other energy suppliers. No doubt the directors felt that offering some sort of charitable support would have benefits such as enhancing the company’s reputation (or reducing reputational harms resulting from high prices), and potentially discouraging adverse policy actions in response to public outrage about high energy prices and occasionally high energy company profits.

But it is a strange situation when a company is pilloried for doing the exact job for which it exists – to make profits for its shareholders. It is also distasteful, and while it is understandable that people struggling with high costs are unlikely to care about the finer points of market capitalism, politicians ought to know better. Companies making high profits while acting within the law is not an outrage – it is actually what they are there for. Complaining about it, is to fundamentally mis-understand (or pretend to mis-understand) the purpose of enterprise, and it really needs to stop.

Earning a 2% operating profit margin is not profiteering. It is not unreasonable. It is actually well below what investors can earn in other sectors. One of the reasons there has been a lack of high quality new entrants into the energy supply sector is the low profitability combined with burdensome regulation. Unless suppliers can earn higher profits, this will continue to be the case, and it is irresponsible of politicians to point fingers at businesses trying to carry out their statutory duties, instead of developing meaningful approaches (such as cutting taxes) to support those struggling with the effects of inflation across the economy.

.

Of course, I have every sympathy with people struggling with high energy costs. But the answer is not to complain about companies being reimbursed for legitimate costs to serve. There are many issues with the retail energy market, but excess profitability is not one of them, and if there were better social protections in place for consumers, such as a social tariff, there would be much less of a focus when energy companies do manage to make a profit.

The govt shouldn’t have subsidised the cost of energy so much as this suppressed demand destruction. Had they offered nothing or what they should have done was made it more targeted then suppliers profitability would have been squeezed and they may have reacted accordingly on pricing. Reality is it suits the govt to have high profits as it gains high corporation tax payments. The whole energy market is becoming an over complicated mess and one has to wonder if it was just left to the market would consumers get a better outcome.

I definitely think the outcomes would be better all round if the market was left to set its own prices, with a social tariff or other benefits to support those in need (people who need to run medical equipment at home for example should get support). I think you’d see entirely different pricing models emerging, as in the telecoms space, where people combine energy with flexibility and flexible devices. Right now no-one benefits – not even the Government through corporation tax since profits in the supply sector are far lower than elsewhere in the economy.

he dog that didn’t bark in the night.

According to the CFD Auction timetable, today, August 8th:

Delivery Body issues a ‘Notice of Auction’ inviting qualified applicants to submit sealed bids

The ‘Notice of Auction’ will specify that an auction is to be held and the deadline for the submission of sealed bids

There has been no such notice publicised. That means that there are insufficient potential bids to merit an auction. All applicants will therefore get the full Administrative Strike Price for their technology. This is likely to mean very small volumes of expensive tidal (£270/MWh in today’s money) and floating wind (£155/MWh in today’s money), and perhaps a few solar projects if they can get a grid connection, but even these must be in doubt. It increases the probability that there are no bids at all for ordinary offshore wind.

Great article, defending the purpose of the greedy corporate world…

I have a few notes:

The comparison of EBITDA margin of BG (2%) with Tech companies (Rightmove – 79%) does NOT make any sense, as these are DIFFERENT industries. Supermarkets, restaurants, Google, Pfizer, have different profit margins…Surprise?

The difference between a utility company (BG) vs Rightmove is that I DON’T HAVE to use Rightmove, but I DO HAVE to use gas to heat my home.

If BG’s 2% margin in 2022 was not sufficient to do any innovation, then the 8% (2023) should bring additional 6% to innovate, right? OR is 6% will go towards shareholders and there would still be none left? It reminds me of Thames Water, saying they have no money to innovate as the money is gone with the shareholders!

Hey, I understand the frustration with British Gas’s profits, but considering the broader context and market dynamics, it’s clear that there’s more to the story than meets the eye. Let’s hope for transparent discussions around the regulatory changes to gain a clearer understanding of the situation.