Many industries have been hit hard by the covid-19 crisis, including the energy sector, but energy supply businesses were in trouble even before the novel coronavirus struck. This year another five suppliers have disappeared – Tonik Energy, Gnergy and Effortless Energy all folded while, council-owned Bristol Energy and Robin Hood Energy sold their consumer books to other suppliers.

Supplier failures continue….

The first failure came in mid-March, before the lockdown turned the market upside down when Genergy folded having failed to comply with a final order from Ofgem requiring it to pay its Renewable Obligations. The company’s 9,000 customers were taken on by Bulb Energy.

In June, council-owned Bristol Energy put itself up for sale, subsequently selling its business consumers to Yu Energy for £1.34 million and its consumer book to Together Energy for £14 million. Despite receiving £36 million in investment from Bristol Council since it was founded in 2015, the company was unable to turn profit, losing £10 million on £76 million of sales in 2019. However the company remains at least partly in municipal hands since Together Energy is 50% owned by Cheshire-based Warrington Borough Council.

September saw the closure of Robin Hood Energy and Effortless Energy. Robin Hood Energy, owned by Nottingham Council was founded in 2015 with the aim of helping people struggling with their bills, believing that because it was not trying to make a profit, it could undercut the Big-6 and gain market share. At its peak it supplied 125,000 customers around the country, and its turnover went from £4.6 million in 2015-16 to almost £100 million in 2018-19, but it made losses every year but one, and by March 2019 it had losses of more than £34 million. The company failed to make its Renewable Obligation payments in 2019 and again in 2020. Its 112,000 household and 2,600 business customers were transferred to British Gas, and its 230 staff were made redundant.

Auditors Grant Thornton calculated the council had invested a total of £43 million into the company and risked £16.5 million in guarantees, however, in a Public Interest Report, the audit firm said the council did not appreciate the size and the risks involved in the business, accusing it of “institutional blindness” with a determination that the company “should be a success”, despite a deteriorating financial position.

The 2,500 customers of Effortless Energy were taken over by Octopus Energy.

Finally, this month, Tonik Energy became the third and largest supplier to fail, just days after it was named by Ofgem as one of the suppliers that had defaulted on its Renewables Obligation and Feed-In-Tariff payments. Scottish Power has been appointed as the Supplier of Last Resort (“SOLR”), taking on its 130,000 domestic customers. In addition to defaulting on its regulatory payment obligations, Tonik had been rated poorly for customer service coming in at the bottom of the most recent Citizens Advice ratings table.

….with defaults on regulatory payments heralding more to come….

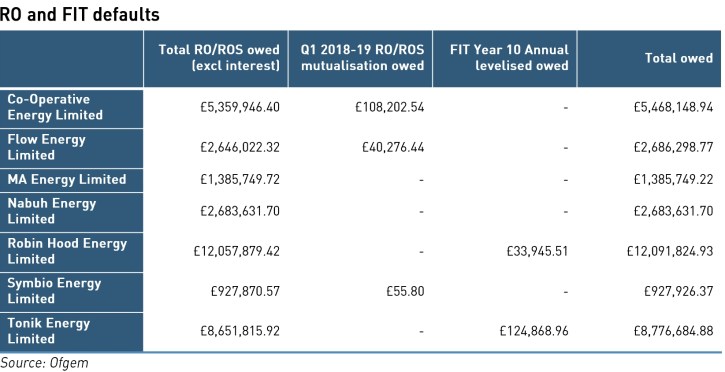

At the beginning of this month, Ofgem announced that seven suppliers had failed to make payments into the Renewables Obligation and Feed-in Tariff schemes. Two of these, Robin Hood Energy and Tonik Energy have already gone bust, the other are Co-Operative Energy, Flow Energy, MA Energy, Nabuh Energy, and Symbio Energy

This year, 24 active suppliers missed the deadlines to either submit Renewables Obligation Certificates of make payments into the buy-out fund, but 17 of these have either since paid the amount owed or given satisfactory assurances to Ofgem on meeting their obligations.

If the final orders for payment are confirmed later this month, the defaulting suppliers will be compelled to make their payments by 31 October, and if they fail to do so, Ofgem could start the process of revoking their supply licences.

Co-Operative Energy Limited, Flow Energy Limited and Symbio Energy Limited also missed the deadline for the mutualisation payment for the first quarter of this year, with total outstanding payments amounting to £148,534.

Shortfalls in the late payment fund for the Renewables Obligation scheme will trigger mutualisation if the relevant threshold (£15.4 million for England and Wales, and £1.54 million for Scotland) is met. This means that suppliers who have already complied with their obligations will be called upon to make up the shortfall.

Co-operative Energy and Flow Energy have both been acquired by Octopus Energy but the money owed relates to the period before the acquisition, so Octopus is not liable for the obligation.

…and the impact of covid-19 hitting hard

Concerns are growing among suppliers that the autumn will see a surge in bad debts as the Government ends the job retention scheme, making energy bills less affordable for households as businesses lay off previously furloughed staff. Even staff that are retained under the new Lockdown Job Support Scheme will see a drop in income relative to the furlough scheme. At the same time, energy demand from households is beginning to ramp up with the colder, darker days, increasing the size of consumer balances.

“The thing that we’ve been very conscious of since March is the risk of a large number of customers getting into financial difficulty and not paying their bills. I know the government has provided a huge amount of support through things like the furlough scheme. But there is a strong risk that if there’s a second wave and if there’s high unemployment that a large number of businesses in the UK will find it challenging with non-payment by customers,”

– Hayden Wood, Chief Executive, Bulb Energy

Autumn is also the time that suppliers must pay their regulatory payments, and, as noted above, this has proved to be difficult for almost half of the active suppliers in the GB market. Suppliers that fail to make Renewables Obligation payments often go out of business shortly after with mutualisation putting further pressure on the remaining suppliers.

Some good news for suppliers and consumers as the price cap falls…

There is however, a small amount of relief for both consumers and suppliers as Ofgem has announced a reduction in the retail price cap for the winter. The price cap came into force on 1 January 2019, and was initially set at £1,104 for a typical default tariff customer: a dual fuel single rate customer paying by direct debit using a typical amount of energy in annualised terms.

The second cap period (1 April to 30 September 2019) saw the cap level rise to £1,217, before decreasing to £1,143 for the third period (1 October 2019 to 31 March 2020). The fourth cap period (1 April to 30 September 2020) saw a further decrease of the cap level to £1,126.

The fifth cap period covering the six months from 1 October 2020 to 31 March 2021 (and subsequently extended for the rest of 2021) has now been set at £1,042, a decrease of 7%, due primarily to falling wholesale energy prices.

…but suppliers are pulled in both directions by relief programmes…

A measure of good news for smaller suppliers came in June when Ofgem announced a £350 million support scheme for energy suppliers hit by growing numbers of billing defaults caused by the pandemic, allowing them to defer network payment charges for 3 months. The scheme was targeted at sub-investment grade suppliers who would struggle to access alternative forms of liquidity and those that have been unable to access government support mechanisms, and is capped at £1.6 million per electricity supply group and £1.2 million per gas shipper.

“Ofgem expects network companies to support energy suppliers and shippers who are facing cash flow challenges as a result of the unprecedented public health emergency triggered by Covid-19,” the regulator said in an open letter. Our overarching aims during this crisis are to ensure that energy consumers are offered the support and service they need, to minimise disruption for consumers and other market participants that could arise should companies exit the energy market in a disorderly way over the next few months, and to mitigate the risk to consumers of a material decline in competition arising from the potential exit of otherwise efficient suppliers,”

– Ofgem

According to Ofgem, 18 firms had deferred charges under at least one of three schemes as at the end of August, with the value of the deferrals totalling around £39m. The firms are required to repay these charges in full by March 2021, including interest at a rate of 8%.

Some industry members criticised the move, suggesting it rewarded badly run companies, simply delaying the bankruptcies of loss-making suppliers. Those failures could be accelerated by new licence rules that mean from mid-December suppliers will be required to offer emergency credit to customers struggling to top up their prepayment meter, many of whom are likely to be in vulnerable circumstances. Suppliers will also have to offer extra prepayment credit for households in vulnerable circumstances to provide more breathing space while working out alternative arrangements to pay. These new rules make the voluntary commitments made by suppliers when the pandemic hit, a licence obligation.

In September, Citizens Advice found that around 6 million UK adults have fallen behind on at least one household bill during the pandemic, including 2.8 million who have fallen behind with energy bills.

“Coronavirus has pushed many people into debt that will take them years to get out of. We estimate that it would take an average person that we help with debt problems at least 30 months to pay back just their priority debts, assuming that they spent their entire disposable income on repayments each month,”

– Citizens Advice

…..while Ofgem is tightening the rules to protect consumers from weak suppliers

When a supplier fails, it’s customers are transferred to another supplier by Ofgem under what is known as the Supplier of Last Resort or “SOLR” process. This can involve costs for that supplier, which can be reimbursed by making a claim for a Last Resort Supply Payment. If approved, these payments are made by gas and electricity distribution network operators and recovered from consumers through use-of-system charges. In other words, gas and electricity customers can see bills increase to cover the costs of failing suppliers.

For example, last year, EDF Energy was appointed as SOLR when Solarplicity collapsed. Solarplicity exited the market in August 2018 – two months after selling the majority of its customers to Toto Energy, which also collapsed in October last year, with EDF again being the appointed SOLR. EDF has made a claim for £4.5 million of additional costs – £3.3 million of credit balances already repaid to former customers of Solarplicity, and an estimated £371,000 of credit balances which still need to be paid. Ofgem will make a final decision in November, taking into account any monies recovered by EDF in the liquidation process for the defunct supplier, however it has said it is minded to accept all of EDF’s claim.

Including EDF’s claim, there have been £17.9 million of Last Resort Supply Payments made this year.

With high numbers of supplier failures in recent years, Ofgem is keen to reduce the impact on consumers by tightening up the rules on market entry and ongoing licence conditions. In June, the regulator published its statutory consultation on the final phases of its Supplier Licensing Review (“SLR”), indicating that it intends to take forward the majority of the policy proposals it had previously discussed.

The key feature of the proposals are:

Promoting more responsible risk management: measures intended to ensure that suppliers are prepared for growth and to meet their regulatory obligations, by introducing:

- A principles-based requirement for suppliers to minimise costs that could be mutualised in future. This is a significant change which will ensure that Ofgem is able to take action where suppliers are not managing this risk effectively. Ofgem is also considering further, more prescriptive requirements around credit balances and environmental obligations, however stakeholders have expressed serious and credible reservations about the impact on future entry and competition, so these would be subject to further consultation;

- New checkpoints for suppliers, based on customer numbers and financial and compliance indicators, at which Ofgem would scrutinise suppliers’ readiness for growth and ability to meet their regulatory obligations. Ofgem may impose additional restrictions on individual suppliers, for example a restriction on taking on new customers, if they are not ready for growth or able to meet regulatory obligations;

- A new principles-based requirement to ensure suppliers have sufficient operational capability and adopt overall better risk management practices.

Improved governance and increased accountability: proposals to increase accountability, and incentivise responsible and appropriate behaviour from those in senior positions, by introducing:

- A requirement for suppliers to ensure that individuals with significant influence in the business are fit and proper to occupy their role;

- A new principles-based requirement for suppliers to be open and co-operative with the regulator.

Increased market oversight: measures to ensure Ofgem can identify potential risks to consumers or competition, and take timely action where appropriate, by requiring suppliers to:

- Undertake, at Ofgem’s request, an independent audit of their financial position and/or customer service systems and processes;

- Maintain “Customer Supply Continuity Plans” (formerly known as Living Wills), so that customers are protected and wider market impacts are minimised, should they exit the market;

- Promptly report changes in control of the business to Ofgem.

The main changes from Ofgem’s previous consultation are:

Cost mutualisation: introduction of a Financial Responsibility Principle to drive suppliers towards responsible behaviours that should minimise the costs that are mutualised in the event of failure.

Milestone assessments: Changing the milestone assessment thresholds from 50,000, 150,000, 250,000 and a point to be determined between 500,000 and 800,000 domestic customers to just 50,000 and 200,000 domestic customers. Under the final proposal, suppliers would not be prevented from exceeding the customer number threshold until they have passed the milestone assessment, but Ofgem could take action if it appears that the supplier is contravening or likely to contravene its obligations, including by limiting further customer growth.

Dynamic assessments: In addition to milestone assessments, Ofgem may require suppliers to undergo dynamic assessments at points at which it has concerns about their financial position. The conditions under which a dynamic assessment would be needed include financial warning signs such as missed payments, customer service indicators and pricing practices. They would not be automatically triggered, but would be based on Ofgem’s assessment of the information it has on the supplier’s situation.

Customer supply continuity plans (formerly “Living Wills”): All suppliers will be required to produce and maintain a plan that is proportionate to the scale of its business. Suppliers will not be required to publicly disclose the content of these plans as part of the new licence condition.

Independent audits: Ofgem has clarified the circumstances in which it would compel a supplier to commission an independent audit, and more clearly articulated what it would consider to be ‘independent’.

Trade sales: Ofgem proposes to introduce a licence condition that prevents licensees from engaging in commercial transactions that subvert or distort, or are likely to subvert or distort, the Supplier of Last Resort process.

These changes are welcome. Suppliers face a wide range of regulatory obligations, both payment obligations and information obligations, that apply at different points in their evolution, with some being linked to customer numbers. It is actually very challenging for new entrants to make sense of these obligations – I have carried out reviews of these for new entrant supplier clients, and discovered first hand the highly fragmented nature of the information on these obligations – in some cases I had to refer to primary legislation to be sure I correctly captured the full extent of the requirements.

Understanding the rules is only the first step: suppliers then need to configure their systems and process to ensure compliance. This means embedding the capability to change the way bills are calculated to reflect changes such as different thresholds for recover of different environmental and social costs, and indeed changes to the costs themselves as old subsidy schemes are retired and new ones introduced. A large part of the activity of energy suppliers, particularly in electricity, is the collection of various levies, the administration of which is challenging.

Life for suppliers is unlikely to get any better

Energy supply has been a dysfunctional, low-margin market for some time. Energy is an essential requirement for daily life, but it is a commodity – despite efforts of some suppliers to “green” their offer, one kWh of electricity is identical to the next at the point of use, making it hard for suppliers to differentiate themselves. Typically this is done on price, with low-price offers made to attract new customers. But as customer numbers grow, new cost obligations arise, reducing margins for the supplier – indeed, Ofgem’s analysis clearly illustrates how little suppliers make on electricity supply to domestic consumers (and the latest figures indicate that margins on gas are also now negative).

With covid hitting both domestic and business consumers hard, payment delinquencies are on the rise while suppliers are required to provide greater support to vulnerable customers.

Forcing potential new suppliers to prepare better for market entry is helpful, but more radical changes are needed to make energy supply a properly functioning market: stopping using suppliers as tax-collectors and abolishing the pointless price cap would have an immediate, positive impact on the market (and liberate the regulator from having to police and administer such low-value activities).

.

Leave A Comment