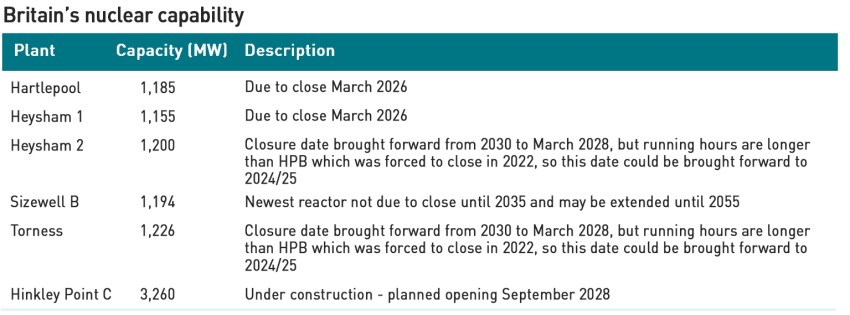

Last week came the welcome news that EDF will extend the lives of its Heysham 1 and Hartlepool nuclear reactors by a further two years to March 2026. The company had hinted at a possible extension back in September but the subsequent inclusion of nuclear power in the windfall tax put the decision in doubt. Having secured contracts in this year’s T-1 capacity auction, the plants were likely to remain open until September 2024, but that could potentially have been achieved by simply managing the fuel.

This announcement secures their lives for a further two years provided that the results of regular graphite inspections remain positive and the Office for Nuclear Regulation agrees. Two previous reviews resulted in the reactors having their lives extended by 10 years. The estimated closure dates for Torness and Heysham 2 remain unchanged at March 2028 however both of these reactors have run for longer than Hinkley Point B which was forced to close in 2022 following the discovery of cracking in its graphite cores.

However, EDF has also announced there may be further delays to its new British reactor at Hinkley Point whose opening could be pushed back to September 2028. That means that by the time it opens, there will only be one nuclear power station – Sizewell B – operating in the UK, posing real risks to security of supply as this decade progreses. The cost of Hinkley Point C has also ballooned from its initial estimate of £18.1 billion to £32 billion.

Meanwhile EDF’s first EPR (European Pressurised Water Reactor) in Europe, Olkiluoto 3, is limping towards an opening which keeps being incrementally put back. The latest date is now 17 April. The plant had been expected to open in June last year, but this was put back after material was found to have detached from the steam guide plates and entered the steam reheater of the turbine. Then in October, cracking was found in all four feedwater pumps at the reactor, pushing the expected opening date to December. When December came opening was delayed to February when it was pushed to March, and then to April.

The news at the flagship plant at Flamanville is no better. In December EDF provided an update saying that fuel loading, which had previously been scheduled for Q2 2023 will now take place in Q1 2024. It also announced a cost increase to €13.2 billion, up from the previous estimate in 2022 of €12.7 billion. The company is still in the process of repairing 122 faulty welds.

This brings the start date to within months of the deadline of the end of 2024 for replacing the pressure vessel lid, mandated by regulator Autorité de Sûreté Nucléaire (“ASN”) after the discovery of excess carbon in the steel. In 2018 when ASN made the stipulation, this was expected to be the time of the reactor’s first re-fuelling. EDF has requested an extension of the deadline to avoid having to shut down the reactor after just a few months of operation, but there is no guarantee that the plant will open on Q1 2024. ASN may just require EDF to replace the lid before opening, rather than moving it to the date of the first re-fuelling as requested by EDF.

Stress corrosion problems still not resolved

In October 2021, EDF discovered stress corrosion cracking during the ten-yearly inspection of the Civaux 1 reactor. This turned out to be a generic problem on N4 and P4 reactors which led to the closure of 12 reactors during the winter of 2021-2022. By November last year, 115 welds and 230 samples had been assessed. The investigations found that the 16 newest reactors were more prone to the phenomenon due to the sinuous design of their emergency cooling pipes, although cracks could also be caused by welding and other defects.

The inspection and repair work is challenging – according to Bloomberg each weld takes at least three days to complete, with workers often on their knees or backs to reach for the correct angle. Even in radiation suits, health regulations limit work in that environment to a maximum 40 hours a year. 100 specialist welders have been brought in from North America to work alongside 500 local metal workers and engineers. Tools have had to be adapted for working in confined spaces, with welders using mirrors to work on piping located close to walls.

“These are complex situations, in a noisy and radioactive environment…Workers can sometimes only hold their position for just a few minutes before they need to be replaced,”

– Laurent Marquis, a manager at Altrad Group-Endel which is coordinating the repairs for EDF at Penly

Of the dozen reactors where pipes were cut for checks, EDF found no sign of cracking in three of them, while two had cracks caused by welding defects where tiny portions of metal had been insufficiently melted. However, in the majority, stress corrosion was found resulting in cracks as deep as 6 millimeters. EDF plans to replace emergency cooling system piping in seven reactors as a preventative measure during planned outages of 160 days, starting this spring, to avoid doing weeks of checks only to find the pipes need replacing anyway.

Last week, ASN announced that EDF had detected a “non-negligible” defects in welds on emergency pipes in two reactors: Penly 2 and Cattenom 3 where thermal fatigue cracks have been found during inspection. This discovery comes two days after the revelation of a crack of a size never seen before in the Penly 1 reactor. The crack at Penly 1 extends over 155 mm, or about a quarter of the circumference of the pipe, and its maximum depth is 23 mm, for a pipe thickness of 27 mm.

This particular pipe had not been considered by EDF as not susceptible to stress corrosion cracking due to its geometry. However, this weld underwent a double repair during the reactor’s construction, which could have altered its mechanical properties and the internal stresses of the metal. However, the discovery of this crack means that this piping must now be considered vulnerable, and EDF has been required to update its approach to the stress corrosion issues as a result. The company is now checking welds on other emergency cooling lines that have been repaired in the past.

ASN says that while this crack is concerning, the safety system for the nuclear reactor is designed so that it could tolerate a rupture of one of these coolant pipes. Some of the corroded pipes at the Penly and Cattenom have already been replaced, but it is not clear if that includes the severely cracked pipe.

The crack at Penly 2 is 57 mm long and represents less than 10% of the circumference, with a maximum depth of 12 mm, while the crack at Cattenom 3 is 165 mm long, about a quarter of the circumference, with a maximum depth of 4 mm.

The discovery of these new defects could disrupt the maintenance schedule of French nuclear fleet. As a result of the stress corrosion issue, EDF has to inspect 200 welds across its reactors, which could lead to further outages and increased uncertainty over nuclear output during 2023 after severe disruption last year. As these new cracks are due to thermal fatigue rather than stress corrosion EDF will have to adapt its maintenance program to include thermal fatigue checks.

“The discovery of this materially worse-than-expected defect is likely to lead to more rigorous quality control and potentially longer outages…If this were to be the case, we would expect the French power-price outlook to increase,”

– Vincent Ayral, analyst at JPMorgan Chase

Output from the French nuclear fleet fell from 361 TWh in 2021 to 279 TWh last year. EDF estimates it will recover to 300-330 TWh in 2023, but that still means France could require imports for a significant portion of the year, and the identification of new cracks, or delays in the repairs – France is currently experiencing strikes including among nuclear workers – could see production fall below estimated levels. So far in 2023 output has been lower than last year: 30.8 TWh versus 25.3 TWh for January and 59.6 TWh versus 64.8 TWh in February. Although some of the affected reactors have re-opened, others have seen their closures extended.

- Cattenom 1 (1.3 GW) re-opened on 5 February 2023

- Chooz 2 (1.5 GW) re-opened on 8 February 2023

- Cattenom 3 (1.3 GW) will be closed until 26 March 2023

- Civaux 2 (1.5 GW) will be offline until 20 March 2023

- Chooz 1 (1.5 GW) will remain closed until 4 April 2023

- Flamanville 1 (1.3 GW) will be offline until 2 June 2023

- Golfech 1 (1.3 GW) will remain closed until 11 June 2023

- Penly 1 (1.3 GW) will be closed until 2 May 2023

- Penly 2 (1.3 GW) will be offline until 11 June 2023

EDF is still trying to understand the speed at which cracks progress once they appear. This means it faces tighter and more frequent monitoring of its reactors, and the replacement of the piping in the seven reactors planned for this year is unlikely to be the end of the story – EDF expects that it will continue to encounter issues relating to stress corrosion into 2024 and 2025.

Beyond this, the French reactors are aging – most were built from the late 70s to the mid-90s, and now require longer down time for maintenance and repairs. ASN has previously warned that the stress corrosion issues may not be the last problems uncovered. Countries such as Britain which have long relied on French electricity imports should take note.

Troubled history of the EPR

An interesting update as always, I wonder if you can give your opinions on the below:

Why with all of the difficulties that the EPR had experienced in France and Finland that were widely discussed for years beforehand did the UK govt decide to commit to that design?

Why are the costs of HPC so much higher than the costs of the EPRs in Europe? Is this purely a function of inflation (2020s prices vs 2000’s prices) and in real terms the costs are similar, or is there other factors preculiar to the UK that leads to that difference?

Your thoughts / insights would be appreciated.

So my understanding is that the Goverment went with the EPR because of a lack of alternatives – this was before the Wylfa project was put forward. However I reject that argument because as my timeline shows, the probelms with the EPR were apparent by then and the Government could have held off and asked the market to come forward with other options. It would also have put out a tender to buy reactors itself, which is still what I think it should do rather than faffing around with compex incentive schemes.

I think the initial HPC budget was intended to include a lot of fat to avoid the cost inflation seen on the other projects, but covid and the post-Ukraine supply chain cost increases have meant costs have gone well beyond that. There must also be cost inflation due to the design because covid/Ukraine don’t explain the scale of the increases to my mind.

Thanks for your insight on those, I suspected that was the case for both questions. One thing you dont discuss in the article is how the potential ‘nuclear gap’ in the UK can be bridged based on the timelines you detailed for plant closure. If we accept that HPC will begin generating in Sept 2028 (which to me seems 50/50 at the most optimistic based on the other EPR experiences) and the second UK EPR has not even begun breaking ground then where does that leave us? Even if a new EPR was approved today in the UK then we are looking at mid to late 2030’s for that to be complete (again optimistic estimate). With no coal units and an ageing CCGT fleet the UK seems especially vulnerable to gaps between generating capacity and demand spikes – any thoughts on how we can square that circle? BTW I am sceptical that modular nuclear can be that bridge – even if they were commercially scaled up they also look like 10-15 years away plus I think local opposition to these being sited near population centres will be massive. As always, interested to hear your thoughts / insight.

My feeling is that we will see an extension of coal – RATS could stay open past 2024 for sure. The two Drax units still running coal are set to close at the end of this month but I hear there are moved to keep it open, so this will be a good test of whether realism is setting in. There are also noises about more nuclear support in the Budget tomorrow, but I suspect it will be more EPRs which I’m dubious about for 2 reasons: 1 they seem impossible to deliver and 2 I’m not sure even EDF is that committed to them any more since in France the talk is all about EPR2.

Of course there is also an expectaion we will have SMRs but the earliest delivery date for those is the end of this decade, so as you say, there is quite a gap. The new Eggborough CCGT should be open by 2027 and we do also have the two Calon CCGTs available to return to the market with some return to service work, but that is measured in months not years. A couple of large OCGTs are also under construction and ought to open in the next couple of years.

Realistically the only options to fill the nuclear gap are to keep the coal and build more gas. At a pinch you can build a CCGT in 2 years…

Although HPC nuclear looks very expensive right now, compared with offshore wind, this is with the benefit of considerable hindsight.

(All prices in 2012 pounds and have annual CPI uplifts.)

When the HPC contact was signed in 2016 for £89.5/MWh, the 2015 CfD AR1 auction contracts for offshore wind were for £114.4 to 119.9/MWh. So HPC was noticeably cheaper at the time.

In 2016, there was some belief that offshore wind was going to get somewhat cheaper as time went on. But there was certainly no widespread belief in 2016 that the minimum bids for offshore wind in the 2017 CfD AR2 auction were going to halve, bring the AR2 range down to £57.5 to 74.8/MWh. Nor was anyone giving odds on a further 30% offshore wind reduction in AR3 and now we are down to £37.5/MWh for 2022 CfD AR4 offshore wind.

So it was reasonable in 2016 for the government to bet that the known EPR problems at the time of HPC contract signature could be resolved over time and that there wasn’t a clear and obviously cheaper technology (such as offshore wind at £37.5/MWh) at the time, which ought to prevent HPC contract signature. So the UK government signed up to HPC.

As of today, however, it is clear that a combination of cheap offshore wind and additional CCGT or OCGT backup plants to provide peak capacity, can handle increasing demand, while reducing CO2 emissions and keeping costs reasonably low. Fortunately the capital costs of new CCGT are low compared to even those of offshore wind at £37.5/MWh, even while the load factor of the CCGT is expected to dip below 10% by 2030. So it doesn’t cost that much on the average price of electricity to build new CCGT or OCGT plants then only use them less than 10% of the time.

In this context it would now be a poor government risk to go for a lot of nuclear in the form of the EPR, hoping that all the technical problems could be resolved and the capital cost envisaged in 2016 was still a good estimate beyond the first couple of reactors. Better to take a cautious approach and let someone else iron out all the bugs and resolve the cost issues.

But the government has another factor to take into consideration, which is that nuclear powered ships and subs are seen as key to the successful defence of the UK. Thus, as well as a military nuclear power programme, it makes sense to have some sort of commercial nuclear programme, to ensure the skills pool and training has the critical mass that can continue to support the military naval requirements. Running the commercial nuclear programme at maybe 15-20% of UK grid supply likely would achieve this. Such a commercial nuclear programme would be consistent with completing HPC and contracting for both Sizewell C and, say, another 2 GW of SMRs, for an 8.4 GW total nuclear capacity. 8.4 GW would be 20% of a 42 GW grid supply, which allows for a little growth over and above 2019 through 2022 UK demand and supply.

With the target of 50 GW of offshore wind, plus 8 GW of nuclear, it is likely there will be quite a few times when the offshore wind is delivering 80% of the 50% capacity i.e. 40 GW, generation, plus 8 GW of nuclear for a total of 48 GW of generation, at times when the demand is not there, such as overnight. Even just the offshore wind would cause a surplus. The obvious first step to use surplus wind/nuclear power is to make sure there is enough interconnection capacity available to countries using despatchable generation which can be modulated down. This includes most of northern Europe but excludes France, whose nuclear output cannot sensibly be modulated down just to absorb UK surplus power. Norway could absorb quite a bit, up to the limits of interconnector capacity and overnight demand. Ultimately, these countries might well install their own wind power and be reluctant to help out UK by buying its wind power surplus.

UK green hydrogen production is another possible way to us surplus UK power after 2030, to provide green fuel for the backup CCGT when it fills in the gaps in wind and solar and removing the residual UK grid emissions.

Around 2030, a wind + nuclear surplus is much more likely in winter than summer. Offshore wind capacity factors are around 50% higher in winter than summer, but UK winter electricity demand is only 10% higher than summer demand. This will change big time if UK heat pump installations ever get going properly, quite possibly after 2030 – it is difficult to see it taking off big time before then. The nuclear power may not help much here in that any halts for maintenance or refuelling are usually scheduled for summer rather than winter. Maybe such pauses should start off in winter, then switch to summer when the UK heat pump load really takes off?

I have two comments to make on this article..

Firstly even the £32billion ballooning cost is less than our government managed to splurge on one phone app.

Second is a bit longer.

A friend of mine is a high skilled welder of many years experience. With his qualifications and experience he can demand very high hourly rates.

He says that he often applies for a job which depends on high integrity welds. As part of the interview he would do demonstration welds.

He would then find that, even with his outstanding CV and having made perfect welds, he still did not get the job.

He was convinced that the company would then use a less skilled employee to impersonate him, producing inferior welds at a consderable saving. The customer, of course was unaware of this: having inspected the test welds as satisfactory, they thought they were getting the superior workmanship they had paid for.

I have no doubt this would have also happened in other countries and may be the root cause of EDF’s joint woes.

Your friend’s story is quite worrying. When the ONR inspected the welding at HPC it found the welders were from France and didn’t speak English so an interpreter was needed to translate the foreman’s instructions. Not ideal…

(btw, the app did NOT cost £37bn… that was the total budget for Test and Trace over two years, with £13.5bn spent in 2020-21, with £10.4bn of that being for testing. £35m was spent on the app in 2020-21, and I read recently that apparently it actually worked okay for its purpose in the end…)

Good Evening Kathryn,

A very insightful post, thank you. I have a few questions, somewhat unrelated but I’m curious to know your thoughts?

1. Why has the UK been so bad at investing in the nuclear industry. An example, the Rolls-Royce SMR, I get the feeling that the idea was formed out of the “good-ideas” club. Brilliant for redundancy within the Grid, and I’m all for that. However, it has sustained little traction over years. Until catastrophe occurs in the energy sector, and Govt decides we need a more stable supply. Is it a question of human psychology? Does the UK Govt have the habit of being reactionary, and not proactive?

2. Subsequently, are we as a nation reluctant because we still don’t have a sustainable and reliable waste disposal/repository infrastructure. Do we need to tackle one problem before moving onto the other?

I don’t think the slow pace for SMRs is really down to the Government. RR is not going particularly slower than Nu Scale in the US which ha a similar time to market. I think the issue with large nuclear projects is fear of the cost and an unwillingness on the part of the Government to spend its own money. It has spent years messing around with complicated incentive schemes to try to get private investors to build these projects but the costs and risks are high, Had the Government simply decided to build some itself we would have them by now (by that I mean pay for them directly but tender out the construction, I don;t think the Government should be setting up its own nuclear construction business).

The waste issue relates to legacy waste. The waste from modern ractors has perfectly good disposal methods and the volumes are relatively small compared with all of the other toxic waste produced in the UK every year. The issue is with the mess at Sellafield where historic waste was not managed properly and has left a huge clean up requirement.

Its a wonder the human race managed to build any reactors and run them reading this!!

French i/cs has been flat out on import all day despite wind production being high.

I think you will find that the initial cost estimate of the Okilutoto power station in Finland was originally set as 3 billion euros, rather than the 3.7 billion that you state. Hence the exponential rise in its costs has been even higher than you state. It is indeed now 14 years overdue.

Thanks – I’ll update the chart

Good Evening Kathryn once again,

What is your take on the RR SMR project? I suppose the UK plc has the SQEP, but do those with authority have the motivation?

Recent events (with regards to energy insecurity), lead me to believe that the Govt. has committed to progressing the project as a knee-jerk reaction. Not because we are forward thinking.

I have experienced multiple complex projects over my career, and I understand that CADMID cycle truly incurs unforeseen costs.

I think the question I’m asking is, what holding us back as a nation ensuring our future energy security with nuclear plants?

Looking forward to your response.

I think SMRs are a very interesting concept, both RR and Nu Scale in the US. However commercialising this technology takes time and neither company expects to be ready much before the end of this decade.

There are several things holding us back but the main one is the high capital cost – even for SMRs there’s a huge cost for the factories. This scale of investment is difficult for the private sector to fund but the Government is also reluctant to stump up the money and take the risk. It really requires courage to commit not just from a policy perspective but also from a financial perspective and that commitment just hasn’t been there.

Also because there has been a huge gap in the construction of new plant there has been a major skills exodus. It’s worse here but is also a problem in France where there was a decade when no new plants were built.

Fundamentally the Government needs to make a proper commitment, not just setting targets, but actually investing directly. I would like to see it run two competitive tenders – one for plant construction and one for operation, with the Government buying nuclear power stations and engaging operators to run them with the bulk of the income returning to the Treasury to repay the upfrom cost. All of these incentive schemes – the CfD or cap & floor are simply not working well enough to deliver what we need.

I think that international collaboration is the key to sharing risk and obtaining funding. If several governments are seen to be adopting a sensible approach it de-risks funding, some of which could come via government guaranteed bonds. The bigger market also reduces risk, and means a competent workforce can be built up.

The problem with that has been a failure to look for the most cost effective solutions, with national pride and anti nuclear regulation being major sources of obstruction. The French should have abandoned the EPR design a decade ago when it became clear it was unworkable.

I see that the PM has decided to tear up the Boris Energy Strategy, and to try to promote the development of SMRs. It rather leaves the industry not knowing what they can rely on, although it should have been obvious that attempting to rely on wind without adequate dispatchable capacity is really a non-starter. Even AFRY’s latest apologia for the CCC is talking about 6% unsatisfied demand (three weeks a year of power cuts! – is that sustainable?), and only considers a low wind year (at least they are finally doing that!) as a variant case, rather than a fundamental parameter of system design, while still relying on all manner of unicorns for their fanatasy. One good point about Sunak’s announcement was a recognition that we need to declutter the regulatory process to speed it up. It has long been the case that the main purpose of the ONR has been to try to prevent nuclear development.

Good write-up of the sorry mess of the status quo. There is a lot to get sorted to get to a sensible nuclear policy, yet in the longer run it will be essential anyway. Meantime, the appearance of thermal fatigue suggests that flexing output at the French reactors may not have been a good idea.

Why wouldn’t we in the UK just provide the required capacity of CCGT and OCGT to meet times of minimal wind generation? These plants have much lower capital cost than UK offshore wind farms, even while the latter deliver contracted power at £37.50/MWh in 2012 prices.

There is zero need to risk power cuts, even with a mainly wind and solar UK grid.

It isn’t rocket science – keep the right capacity of natural gas (or green hydrogen) for backup needs, while supplying the majority of UK’s power from cheap offshore wind.

I fear that by default we will go down this route. Unfortunately if we use any gas we will not even get close to net zero. If we use green hydrogen as backup we risk increasing energy usage and emissions particually if we use any gas in its manufacture.

Wonder why the chinese reactors have been constructed so much quicker than the European ones?

Kathryn, the draft has two main and fatal flaws. First, it misunderstands and misapplies the term “intermittent” and adopts a variant of the baseload fallacy. Suitable corrective readings would include:

https://doi.org/10.1016/j.tej.2017.11.006

https://e360.yale.edu/features/three-myths-about-renewable-energy-and-the-grid-debunked

https://doi.org/10.1016/j.tej.2020.106827

https://ieeexplore.ieee.org/stamp/stamp.jsp?tp=&arnumber=9837910

https://www.eliagroup.eu/en/news/press-releases/2021/11/20211119_elia-group-publishes-roadmap-to-net-zero

https://doi.org/10.1109/ACCESS.2022.3193402

Second, it misunderstands the competitive landscape and hence assumes a market for nuclear energy that does not actually exist. These readings may help:

Very short version: https://news.bloomberglaw.com/environment-and-energy/why-nuclear-power-is-bad-for-your-wallet-and-the-climate

Full review article: https://doi.org/10.1016/j.tej.2022.107122

PV status: https://www.cell.com/joule/pdfExtended/S2542-4351(21)00100-8

Oxford INET: https://www.cell.com/joule/pdf/S2542-4351(22)00410-X.pdf