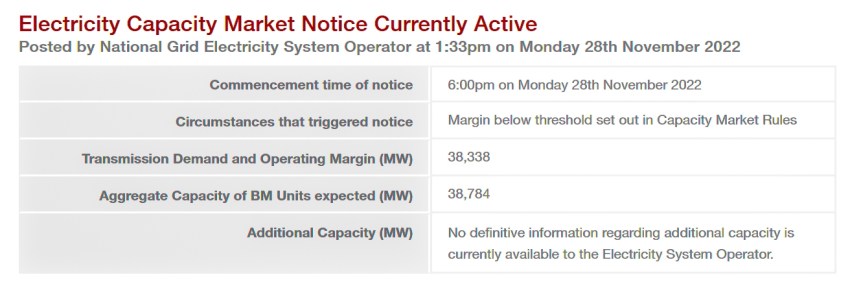

On Monday 28 November, National Grid ESO issued the second Capacity Market Notice (“CMN”) of the winter, again on a day with low wind output. Although the Notice was cancelled after around half an hour, it is certainly a sign of trouble as temperatures begin to fall. There are also concerns for Tuesday as the weather in France is also expected to be cold, meaning imports may be unavailable, leading ESO to consider activating its Demand Flexibility Service (“DFS”) for the first time.

Monday’s CMN was issued just after 1:30pm when the capacity margin was expected to be just 446 MW at 6pm. It was cancelled just after 2pm. At 2:30pm NG ESO confirmed that it would not call on the DFS for Tuesday having previously announced it was under consideration. Prices in the Balancing Mechanism again exceeded £1,000 /MWh with Connagh’s Quay CCGT being accepted at £1,240 /MWh and Coryton CCGT receiving £1,500 /MWh.

“Even though wind is coming back for tomorrow evening’s peak, slow return of nukes in France plus lower temperatures may mean that there is a reduction in available imports across the interconnectors,”

– EnergyAppSys

Wind output on Monday was even lower than during last week’s CMN when output fell below 3 GW, dropping to just 249 MW – less than 1% of the installed capacity. In my analysis of the Winter Outlook, I pointed out that utilisations below 1% were possible in winter and such conditions can coincide with cold temperatures. Luckily temperatures are not currently that low, although they are falling, but during a cold snap if wind fell to these levels and demand rose, imports would not be enough to meet demand – NG ESO would be forced to activate the coal backup and constrain demand.

Monday’s Loss of Load Probability (“LOLP”) peaked at just under 30% but Tuesday is looking even tighter. As I write this at 2:20am on Tuesday 29 November, the LOLP for later today stands at 83% at 4:30pm, 88% at 5:00pm, 82% at 5:30 pm and 85% at 6:00pm. During these times the de-rated margin is expected to be: -1,103 MW, -1,312 MW, -981 MW and -1,050 MW. If these levels do not improve in the coming hours, further CMNs will be issued. NG ESO decided not to activate the Demand Flexibility Service for this evening which may end up being a mistake, although the system operator may be calculating that a combination of imports, reserve and the coal backup might be enough to meet demand.

As temperatures fall, French demand will rise faster than GB demand due to the higher prevalence of electric heating south of the Channel, which may limit the ability of France to provide exports. The expectation for Tuesday is that both countries will experience colder weather than on Monday, and will both need imports, so the evening peak could be difficult. GB wind output is expected to be only around 1 GW during – higher than on Monday, but just a third of that during last week’s CMN. Prices for Tuesday evening reached over £1,200 in the Day-Ahead auction on N2EX.

Winter has barely begun and we have already had two Capacity Market Notices, and possible activation of the Demand Flexibility Service – this does not bode well for the rest of the season. It is to be hoped that this serves as a wake-up call to NG ESO and that it re-visits its capacity margin calculations. Over-estimating the contribution from wind is not helpful, and assuming imports will be available from counties which themselves may be experiencing market tightness is not a recipe for energy security.

The deterministic weather models are now forecasting a deeply negative NAO for the first half of December, this is likely to lead to low temperatures across northern Europe and lower wind speeds. There is also a low probability of more extreme cold affecting Europe and possibly even the UK.

It’s possible UK energy policy may end up being properly tested this December.

Just to comment how valuable I find these market insights to be. I know from other sources that I read that they are being followed by journalists and other market commentators (even if not always explicitly referenced).

Thank you.

Thanks John, that’s nice to hear! I did spend a fair chunk of time yesterday speaking with journalists…

Hi,

I suspect that NG had some interesting times yesterday.

Unit 4 at Ratcliffe broke around 16:00 just going into the peak which must have prompted some crossing of fingers at the time.

By 18:00 imports were running flat out and it looks like the peak was carried on pumped storage.

Not quite sure what was lined up to step in if something else broke.

There are 2 units and Drax and one at WBA so about 1.4 GW capacity excluding RATS in the emergence coal reserve.

I note that neither Drax nor Lynemouth have been running their CFD funded biomass units since the beginning of October when the baseload market reference price shot up to £405/MWh, so that is I suppose an additional reserve, though they might need a very fancy price and plenty of notice if they have mothballed the plant. The 50MW K3 CHP facility (also on BMRP) in Kent has continued to run, racking up a bill of nearly £10m in CFD repayments already. They must have a magical sweetheart deal for electricity sales, or they are going to go out of business.

Outstanding work (however depressing the news may be).

Cheeky ask: the next time you do a GB generation mix graph, would it be possible to overlay the average national temperature against a second axis please? Or does it closely correlate to demand?

Also – what’s in “Other”? Mainly solar?

If you can point me in the direction of a good source of average temperature data through the day then I’d be happy to do that (if I remember!).

Other is mostly biomass and hydro (pumped and not pumped). There’s very little solar at the moment, but that is also included in Other…

There’s always HADCET:

https://www.metoffice.gov.uk/hadobs/hadcet/data/download.html

Do you know if many politicians follow your blogs?

It’s really gas that is highly sensitive to weather.

https://mip-prd-web.azurewebsites.net/DailySummaryReport#TopofthePageSection

The report includes a chart of a composite weather variable. Demand is forecast at over 300mcm/day for today. About 3.3TWh, including the supply to power stations.

You can look at some approximation to electricity demand seasonality by setting the chart here to display the whole time frame, but beware because it takes no account of solar which is of course heavily summer peaked.

https://bmrs.elexon.co.uk/generation-by-fuel-type

Whilst those coal stations would be fine with sufficient notice (I’m guessing 12 hours warm up time) (and I think it is Rats-1 that NG have “bought” for the season), I was more concerned about what happens if, for example, Sizewell has a wobble and 1.2GW disappears requiring immediate replacement. With most of the pumped storage already committed and interconnections maxed out then there isn’t much scope to manage an unexpected loss of generation.

Damhead Creek tripped out 781MW just before 12:20, leading to a frequency dip to 49.726Hz. Outside the norm, but not critical. Of course, not at the peak demand moment either. One saving grace is that there is plenty of inertia on the system with all the conventional plant being run.