Just after 2:30 yesterday afternoon, National Grid ESO issued the first Capacity Market Notice (“CMN”) of the winter, predicting a spare generation margin of just 177 MW at 7pm – CMNs are issued automatically if the margin drops below 500 MW. Although the Notice was cancelled after just half an hour, thermal units were paid almost £1,500 /MWh in the Balancing Mechanism through the afternoon. The forecast Loss of Load Probability reached almost 28%.

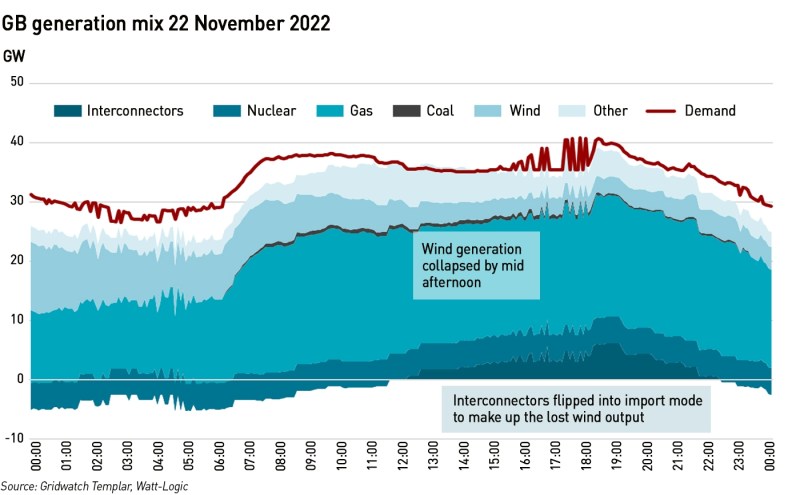

The reason for the tightness was a significant reduction in wind output from almost 12 GW overnight to below 3 GW by mid-afternoon. There were also two of the ten remaining nuclear reactors offline – one on planned and the other on unplanned maintenance, and a couple of other reactors are operating with reduced output for operational reasons. There was also 1.6 GW of thermal generation offline on unplanned outages, as well as three 300 MW units at the Dinowig hydropower facility in Wales. As a result, coal units were ramped up and imports raised – including from France where there was a swing of 4.5 GW with Britain moving from exporting 3 GW the previous night to importing 1.5 GW yesterday afternoon.

Maximum demand over the past couple of days was around 43 GW, lower than the 40.1 GW expected at 7pm yesterday when the CMN was issued, and well below the Average Cold Spell demand of 58 GW outlined in NG ESO’s Winter Outlook. While the weather is colder than it has been in recent weeks, it is about average for the time of year, and well above the temperatures expected in the coldest parts of winter. While there was additional thermal capacity on the system – Unit 3 at Ratcliffe was accepted in the Balancing Mechanism at around half of its Maximum Export Limit, and not at all at 7pm during the period covered by the CMN, during colder weather that capacity could easily be taken up (and RATS-3 earned over £1.7 million in the Balancing Mechanism yesterday).

“CMN forecasts are issued automatically and are only based on information in the public domain. They do not take into account all the factors which our engineers are working on…This is the first tight day of the winter, but it is not super tight. It is a small appetiser of tightness, there will be much tighter days ahead,”

– Phil Hewitt, Director at EnAppSys

With temperatures potentially falling below 30-year norms in the next month, signs are not encouraging. And it should be remembered that with much higher use of electric heating, electricity demand, and therefore prices, rise much faster in France than in Britain when the weather turns cold…in a cold snap we may not be able to rely on the French to get us out of trouble, particularly if there are further delays to the planned re-starts of French reactors.

In any case less interconnector capacity will be available than expected. IFA 1 was due to return to full service in mid-December after a fire at the Sellindge substation last September disrupted operations. The plan was for capacity to rise from 1 GW to 1.5 GW on 17 November and then be restored to the full 2 GW capacity from 15 December.

However, last week the operators issued an updated REMIT notice warning that it would only return to full capacity on 18 January, with the increase to 1.5 GW being delayed until 20 December – this means the line will continue to run at half-capacity for another month. This may not be a bad thing – reduced export capacity may turn out to be helpful if the GB system faces tight conditions at the same time as France, although if both countries experience system stress at the same time, it’s unlikely that the interconnectors would flow in either direction to avoid a bidding war between the two markets.

A CMN this early in winter when it’s not particularly cold is worrying. Yesterday there was some spare capacity in the system to deal with it, but later in the winter when it turns colder, that may not be the case.

Yet another interesting post which highlights a number of issues. Why is planned maintenance undertaken during periods of peak demand – is this unavoidable – who makes these decisions? Is the concern regarding generating capacity new, or is it just being highlighted more due to other issues pertaining to supply? We all know that the wind doesn’t blow all the time and the sun doesn’t shine all the time. Surely (?) we must have adequate supply for these occasions or is this naive?

If during October you notice your plant needs some maintenance you will get on and order the parts and crew for as soon as possible, rather than find the plant breaks down completely in a cold snap in February when it is desperately needed.

I think we can surmise that the CMN was really directed at the interconnector capacity contracts. At 4 a.m. when the wind was still blowing we were exporting over 5.1GW. By midday the balance was essentially zero but by 6:15 p.m. we were importing 6.25 GW.

Meanwhile I note gas flows on the BBZ line to Zeebrugge halted some days ago having been more or less at capacity since the spring. That implies that gas prices are now regaining tight linkage with the Continent, and we will no longer enjoy our surplus discount. That despite ongoing high levels of Belgian LNG imports from both Sabetta and Vysotsk (though the latter might be hit by the pipeline explosion near St Petersburg). The Russian research vessel Nefrit recently spent a couple of days in Kaliningrad revictualling, but is now back on station near the three main breaks in Nordstream. It seems to have surveyed the route back to South of Gotland (where the water is a bit shallower), I suspect trying to work on a feasible repair strategy. It is now being watched by the Norwegian flag Normand Frontier which is also a research vessel.

❝Maximum demand over the past couple of days was around 43 GW, lower than the 40.1 GW expected at 7pm yesterday when the CMN was issued, …❞ There seems to be a typo here.

As per the other comments – it doesn’t add up. Planned maintenance during winter! Dinorwic – 3 x 300MW hydro turbines out of use – didn’t ENGIE replace them last year? 1500 £/MWh (£1.50 per kWh) madness, though the latest DSR promises £3000/MWh (is this what is relied on to keep the lights on?). Burning coal and building nuclear that will not be available for 10 years – or more if EdF continues to not deliver projects on time or on cost! Electricity de France is owned by the French Government (majority share holder and bailed them out of bankruptcy due to nuclear projects being a disaster), now with the UK government part funding so we have the French and English politicians involved! What a recipe for disaster but at least the Chinese are out of it for now. Let’s hope that the wind blows – but not too hard as the wind turbines stop at wind speed over 70km/h (45mph). Maybe the sun will shine for more than a few hours per day this winter. What a mess