Yesterday, National grid ESO published a preliminary Winter Outlook for next winter (2021/22), deciding to come out with an early view following last winter’s market tightness, which I discussed in a series of posts last month:

- With tight margins and high prices, was Winter 2020 a sign of things to come?

- Despite its impending exit coal power was still important last winter

- Falling nuclear capacity adds to winter worries

It’s interesting to see the system operator acknowledge the market tightness which had such a significant impact on prices, with an unexpectedly early comment on the outlook for the next winter:

“Following tighter margins in winter 2020/21 compared to previous winters, we have decided to publish an early view of the margin for winter 2021/22. We believe this will help to inform the electricity industry and support preparations for the winter ahead. We published the Winter Review and Consultation on 24 June 2021. This year’s consultation is currently open and we welcome responses from stakeholders by 30 July 2021,”

– NG ESO

Predictably, the press has jumped on this as evidence of an “increased risk of black-outs”, not helped by the comment in NG ESO’s press release to the effect that it’s confident “there’ll be enough electricity to keep Britain’s lights on,” literally raising the prospect of blackouts.

What is NG ESO predicting?

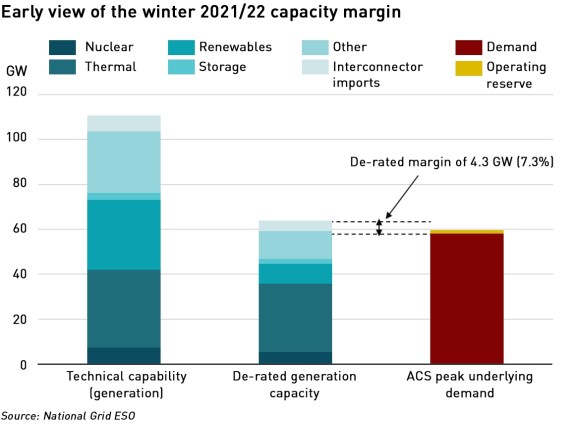

NG ESO currently expects the de-rated capacity margin for the coming winter to be 4.3 GW or 7.3%, slightly lower than last year, but the associated Loss of Load Expectation (“LOLE”) of around 0.1 hours / year is well within the Reliability Standard of 3 hours set by the Government. However it believes that plant outages during periods of low wind and/or tightness across Europe may result in similar challenges this winter to last.

There is also a degree of uncertainty around the de-rated margin, with a possible range of 3.1 – 5.4 GW. While nuclear and coal availability will both be lower next winter, National Grid expects this to be offset by the new interconnector with France, IFA 2, and the link with Norway which is set to begin operations in October.

While the Norwegian interconnector, with Norway’s low weather correlation with the UK may well help boost supplies during periods of market tightness, it is far from clear that the same will be true for IFA 2: the weather patterns that lead to market tightness tend to sit across the northern part of Continental Europe sending demand soaring in all of the connected markets, and many of these markets also rely on Norway to help balance their systems. Even the extensive Norwegian hydro network may be unable to balance all of these demands at the same time.

Demand for the coming winter is expected to return to pre-pandemic levels, with a peak ACS (Average Cold Spell) forecast of 59.5 GW which includes 1.5 GW of operational reserve. Last winter a covid-related demand suppression of 3-4% was assumed.

NG ESO expects neither Dungeness B nor Hunterston B nuclear power stations to run this winter, although Dungeness has a capacity contract which could be traded on in the secondary market, providing a supply boost. The availability of the remainder of the nuclear fleet is assessed at 76% based on an average of the past 3 winters. NG ESO also assumes that Baglan Bay, and the two Calon Energy CCGTSs (Severn Power and Sutton Bridge) will not be available, in line with public announcements, and that there will be no new large CCGTs opening.

The assumptions on renewables, storage and distributed generation are in line with the FES 2021 5-year forecast.

The lower margin range would potentially arise if 1.7 GW of de-rated capacity was not available, which would be more likely driven by lower plant availability than higher demand. The upper margin range would see an additional 1.4 GW of de-rated capacity available which may occur if coal and nuclear availability are higher than expected or if new capacity of plant on long-term outages open ahead of schedule.

On the downside nuclear availability may be lower than anticipated – last year’s availability excluding Dungeness B and Hunterston B was 63%, lower than the 76% assumed in NG ESO’s projections. With more interconnectors in operation there is also an increased risk of a major outage – last year BritNed was offline from 8 December until 9 February, which coincided with the periods of lowest capacity margins.

However on the upside, the two 850 MW Calon CCGTs might return ahead of the winter if sparks spreads are sufficiently attractive. The directors of Calon Energy regained control of the two plants after they exited administration in March via a Company Voluntary Arrangement, and could return to service with a three-month lead-time.

What does this really mean for winter 2021/22?

It’s difficult to assess where margins will land next winter. My instinct is that the markets will be tighter than last year, the correlation between high ACS demand characterised by periods of cold and still weather across Northern Europe (known as Dunkelflaute) driving up demand in interconnected markets, and low renewables availability across the region creates a reliance on traditional generation sources. But with accelerating coal exits and low nuclear availability, the risk of additional plant outages will certainly build pressure on capacity margins.

However, it is important to keep in mind that the system operator’s statutory duty is to meet the LOLE standard of 3 hours, and not to minimise any other effects of tight markets. In other words, NG ESO is not concerned with any impact market tightness might have on prices. Indeed, the prospect of high prices – reflected in much higher futures prices – could be seen as beneficial if it incentivises the re-opening of the Calon CCGTs and brings forward the opening of other plant.

As we saw last winter, it is possible for NG ESO to meet the Reliability Standard while prices are also high and volatile. None of this leads me to change my previous conclusions – last winter’s price dynamics are likely to be repeated in coming winters: it could be a bumpy ride…

I have to agree. We are already seeing rather tight markets, and not merely in the UK but across most of the Continent as well, as a glance at the EPEX price maps will reveal. Winter NBP gas prices are 90-95p/therm, which puts a floor under electricity prices when you add in the carbon price on top. There are going to be some very big increases in consumer bills.

Things like the complete separation of the Nordic market that happened last year due to low demand, failed interconnectors and rising hydro reservoir levels are not going to be repeated. P-F Bach has some very interesting insights on that:

http://www.pfbach.dk/firma_pfb/references/pfb_challenging_summer_for_nordic_power_systems_2020_10_11.pdf

I hope he will manage to provide some further insights in the coming months. He also has some interesting words of warning about internal grid congestion here which are relevant to grandiose assumptions about being able to transfer power at will via interconnectors, and about delays to new capacity:

http://pfbach.dk/firma_pfb/references/pfb_european_electricity_flows_2020.pdf

Our own market is showing the strain in midsummer

https://i0.wp.com/wattsupwiththat.com/wp-content/uploads/2021/07/UK-Day-Ahead-Power-1626998499.12.png

and of course we are burning coal. A number of generators will be looking forward to hours at £4,000/MWh. Given that the EU grid creaked and almost broke last January 8th, the possibility seems to be there of even more dramatic failure this winter.