One of my readers drew my attention to this article about recent Australian electricity price spikes. The combination of a heatwave and an unplanned outage at the 1,050 MW Loy Yang B coal-fired power station were widely reported as causing the shortages leading to prices in Victoria jumping from A$ 86.72 /MWh at 15:30 on 18 January to almost A$ 13,000 /MWh at 17:00. In neighbouring South Australia, prices topped A$ 13,000 /MWh at 17:30. The crash prompted Australian Energy Market Operator (“AEMO”) to announce it had called on Reliability and Emergency Reserve Trader (“RERT”) providers to be on standby.

In fact, as the analysis below from WattClarity indicates, the loss of Loy Yang was not the only contributing factor on the supply side:

The Australian energy regulator is now investigating and will issue a report in the next 40 days.

Two things jumped out at me from the Jo Nova blog: the suggestion that there were available thermal units that were not called despite the tightness of the market, and the speculation of predatory pricing on the part of some generators.

Generation profile on 18 January

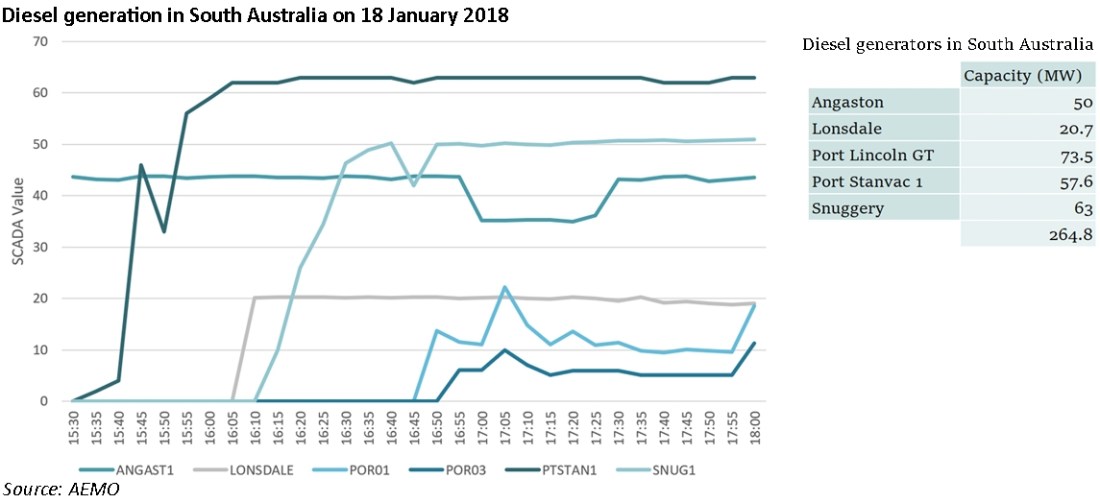

According to AEMO, there are five diesel generators in South Australia (with capacity greater than 1 MW…there are also a couple of smaller units), and they all ran during the affected hours, so it seems the claim that “diesels weren’t needed” was wide of the mark (the original source is behind a paywall, so I have not been able to read it).

In addition, it is highly likely (as the blog also suggests) that on-site diesel generators were also being widely used by industrial consumers, although these are not part of the electricity market.

Did generators take advantage of market conditions to inflate prices?

In order to answer this question, it is first necessary to consider how prices are set in the Australian market.

The National Electricity Market (“NEM”) has five trading regions covering New South Wales and the Australian Capital Territory, Victoria, Queensland, South Australia and Tasmania, which are connected via extra high voltage transmission lines. These interconnectors have sufficient capacity to ensure wholesale prices in each region are broadly similar for much of the time. However, prices can diverge significantly when these transmission lines are constrained. Overall, the NEM incorporates around 40,000 km of transmission lines and cables.

The NEM has a total electricity generating capacity of almost 54,421 MW (as at December 2017), with strategic reserves of demand and generation resources of more than 1,000 MW for 2017-18, and suppliers around 9 million customers. A$16.6 billion was traded in the NEM in the financial year 2016–17.

- The market operates as a gross pool, where all electricity delivered to the market is traded 24-hours a day, seven days a week. The Australian Energy Market Operator (“AEMO”) manages trading in the NEM, according to trading rules governed by the National Electricity Rules. Key elements of the market’s operation include:

- Demand for electricity is matched with supply from generators in five-minute periods in the order of the generators’ bid prices, with the bid price of the last increment of supply determining the dispatch price for that five-minute period;

- Six dispatch prices are averaged every half hour to set the spot price at each half-hourly trading interval for each region;

- The National Electricity Rules define a maximum spot price of A$12,500 / MWh and a minimum spot price of minus A $1,000 / MWh. This negative market floor allows generators to pay to stay online when the cost of staying online is lower than the cost of shutting down and re-starting their plants. For renewable generators, staying online may also cost less than the amounts paid by support mechanisms such as the Renewable Energy Target scheme, plus their own costs.

- Ancillary service markets are used by AEMO to manage frequency, voltage, network loading and system restart processes and allow supply and demand to be continuously balanced within five-minute dispatch intervals.

The primary market participants are generators and retailers, although several large end users are also registered as participants. The market is transparent, with real time supply and demand being available on the AEMO website for market participants, industry and the public to view.

In times of system stress, when there is insufficient supply to meet demand (within acceptable capacity margins), AEMO has a number of reserve capabilities.

The Reliability and Emergency Reserve Trader (“RERT”) is a mechanism for AEMO to contract capacity electricity reserves when a reserve shortfall is projected up to 10 weeks ahead. RERT contracts can be with supply or demand-side participants. The operator can then dispatch these additional reserves if they are needed to maintain power system reliability and security.

Until June 2017, the RERT had been called three times in the history of the NEM but never activated. There had been low engagement over the past decade primarily due to a surplus of generation, however capacity margins are much tighter leading to renewed RERT activity.

Ahead of the current Australian summer, AEMO contracted 1,150 MW of RERT capacity, which has already been called upon twice: in November three providers delivered 112 MW of power and around 240 MW was called on 19 January, when AEMO also declared a LOR 2 for Victoria. The system operator reported that 560 MW of contingent capacity reserve was required, while the minimum available was only 287 MW, leaving a shortfall of almost half of the requirement.

Returning to the question of predatory pricing – this same question was asked in November 2015 when there was a potential scarcity event in the GB market, and a CCGT in Wales earned 50 times the average wholesale price in the Balancing Mechanism.

Comparison with the GB market – self-dispatch

In the GB market, the system operator, National Grid does not make centralised dispatching decisions in the same way that AEMO does. Market participants submit PNs (physical notifications) to indicate their expected supply or demand in each half-hourly settlement period, and energy is traded in the wholesale energy markets which are primarily physical. Physical market transactions form part of the physical positions of each market participant, and broadly speaking the market price tracks the price of the marginal unit of generation.

By gate closure, 1 hour before the start of the settlement period, each participant must submit an FPN (final physical notification) to National Grid, indicating its intentions for each asset at that time. After this point, these profiles may not be changed by market participants, and any unplanned changes will result in an imbalance for that party.

National Grid balances supply and demand through the Balancing Mechanism, the main participants of which are generators who provide ladders of bids and offers indicating the prices at which they would be willing to adjust their expected dispatch profiles in each delivery period. National Grid will accept these bids and offers according to the market needs at the time, optimising the cost of balancing.

In the settlement process, market participants will be paid for or charged according to the difference between their FPNs and actual physical positions in delivery, including any accepted bids or offers, the costs of which are recovered from all market participants through the BSUoS charge (Balancing Services Use of System charge).

Historically, National Grid has procured a range of ancillary services, including reserves for back-up capacity. As a result of the Electricity Market Reforms implemented in 2014, a capacity market was launched in order to guarantee the availability of sufficient capacity at all times. The change was seen as necessary in the context of decarbonisation, where the introduction of subsidised renewables was making new thermal generation uneconomic, risking shortages in periods where renewables were unavailable due to their natural intermittency.

Under the scheme, the full capacity requirements of the system are secure through auctions 4 years ahead of delivery (to provide time for the construction of new generation), with a top-up auction 1 year before delivery. The first full delivery year will begin on 1 October 2018 (a more limited auction was run for 2017/18). Batteries and demand-side-response providers are eligible to participate in the auctions alongside generation that is not already subsidised through other means. Each unit that secures a capacity contract receives an annual payment for availability, and suffers penalties if it is not available when required under the system rules.

A major difference between this scheme and the previous reserve schemes in GB is that the capacity market rewards materially all capacity, whereas the previous schemes were targeted at capacity that would otherwise leave the market due economic pressures.

System stress events in GB

When the GB system is in danger of running short, National Grid informs the market that there is a risk of inadequate capacity through a series of notices, the lowest level of which is an Electricity Margin Notice (previously known as a Notice of Inadequate System Margin or “NISM”). The NISM is designed to stimulate greater availability of generation in the Balancing Mechanism.

There was controversy following a NISM issued on 4 November 2015: Calon Energy’s Severn Power gas plant in Newport, south Wales, was running at the time the NISM was issued, but then started to power down. It was subsequently paid prices of up to £2,500 /MWh in the Balancing Mechanism – more than 50 times average wholesale prices at the time – to ramp back up.

Calon Energy said its Severn power plant “was contracted to run until 3pm. Accordingly, at 3pm it started to ramp down as is consistent with normal market procedure”. Peaking plant is expected to run for very limited numbers of hours, so when it does run, high prices are required to recover the costs of remaining operational.

The NISM was issued at 13:30, requesting an additional 500 MW of capacity between 16:30 and 18:30 on that evening. The fact that Severn was running at the time of the NISM and subsequently began to ramp down while simultaneously offering to continue running at high prices in the BM led to speculation of market abuse – in effect, the plant operators knew that they system was tight and that under market rules National Grid would be forced to accept all available offers in the BM before activating its contingency balancing reserves. Whether the offered prices reflected the real costs required by the plant to keep running or not, the actions of Calon Energy were within the market rules.

Pricing at times of system stress

As noted above, in times of system stress, generating units that are usually uneconomic to run will be called up. These units have very low utilisation rates, but as there are costs involved in maintaining a plant in an operable condition, these costs must be recovered in those limited running hours. By definition, therefore, units that only run rarely will receive much higher prices than would usually be the case in the market, and comparing the prices set by such units with average market prices is not useful.

This doesn’t necessarily mean that the generators aren’t over-charging, but it is difficult to define what “over-charging” means in practice. In the GB market, National Grid was obliged to call all available plant in the Balancing Mechanism before activating its contingency balancing reserves, which creates the scope for abusive pricing: knowing this, marginal generators are incentivised to charge very high prices. This risk has not really been addressed, partly because such opportunities are rare, and partly because of a perception that generators would be shy of the potential reputational damage such actions could create.

In the NEM, this analysis from WattClarity illustrates that there was available capacity that was un-dispatched where generators were bidding into the market at high prices, and not being called. Plant was offering capacity short of its maximum level at prices equal to the market price cap – the cap being designed to limit the abuse of market power by generators.

A 2017 paper from the University of Melbourne indicates that generators in South Australia do have market power due to the concentrated state of the market:

“There are clear signs that a highly concentrated market such as South Australia is prone to abuse of market power. Our recent analysis that combines a game-theoretic analysis together with wind variability, for instance, simulates South Australian spot prices using a Cournot gaming model. When we compare these prices with a perfectly competitive benchmark, the prices at the high end (top 100 hours) is significantly higher by AUD 172/MWh compared to competitive prices and the shoulder period is also more than AUD 50/MWh higher.

These price differences are strong indications that prices during shoulder/peak when contribution from wind are typically low, are susceptible to use of market power in a concentrated market. Since wind generators and generally any new baseload entrant that is not part of incumbent existing dominant gencos do not necessarily benefit from the higher peak/shoulder prices, the current EOM [“energy only market”] design poses a significant challenge for investment leading to a flexible generation mix that supports high renewable penetration,”

– Capacity and Energy-Only Markets under High Renewable Penetration Deb Chattopadhyay and Tansu Alpcan Senior Member, IEEE

Drawing these strands together, it’s difficult to say to what extent the prices set by generators are abusive at any time. Thermal generation with low levels of utilisation can be expected to earn higher returns during the hours it does run, and the fact this plant is owned by relatively few market participants may result in these pries being higher than is necessarily justified.

South Australia and Victoria are experiencing market tightness, but this does not mean there is no spare capacity – if that were the case, actual load shedding (LOR3 conditions) would be taking place regularly, and this is not happening. However, the markets are significantly tighter than the GB market and have little room for manoeuvre, meaning there is a greater risk of abusive practices by generators.

The real lessons are less about the potential for market abuse by generators, but the wider sense of crisis that surrounds the Australian market. Prices spiked again on 7 February, triggering another regulatory investigation and there have been a number of blackouts caused by the effects of temperature on network equipment. According to Tony Wood, energy director of the Grattan Institute (in The Australian, which is behind a paywall, but quoted on numerous blogs):

“We’re dealing with a complex transition and it hasn’t been managed very well so far….That’s why we’ve seen local outages and high prices on the weekend, and that’s the reason why wholesale prices are substantially higher this year than last year.

“It’s a reflection of a failed policy. We’re transitioning away from centralised, cheap but dirty power stations, but we’re not replacing these stations with sources that are just as stable.”

Meanwhile Australian consumers are suffering ever higher prices.

While Australia clearly faces some local challenges, policymakers in London should take note – the Australian market is providing a useful case study in the risks of aggressive de-carbonisation.

Oh, the cost of ‘going green’…

Extreme greenism, extreme cost, extreme problems and brought to us by extremist UN IPCC and global partners.

Ask Germany.

Thanks for these market analyses.

The above comments that its all a result of ‘going green’ miss the point a bit I think. Fossil fuels are ‘fossils’ and will gradually get more expensive to use as they become less available. I think burning them is a waste of a material that has many other uses, eg plastics. So really we should conserve them. If we want to still have a reliable supply of electricity (and more may well be needed to judge by government proposals) then nuclear seems the best, maybe only, option to meet a real requirement. In this situation I see ‘greening’ as a bit of a straw man though some of the market rules are shaped to favour new ‘renewable’ sources over existing thermal plant.

Having read the market analysis above a couple of times (not understanding many points) I consider the ever increasing complexity produces more work for participants. They work hard to get their economics of generation or consumption optimised in a complex set of rules, against other participants and perceptions of the future. The focus is lost between economics and reliable electricity generation.

One could say ‘fiddling while Rome burns’

rant over!

Thanks again,

Nick

Hi Nick,

I’d say yes and no to your comments….I think the idea of peak oil has been pretty much refuted, although obviously in the limit these resources are finite, I don’t think there is any prospect of fossil fuels running out over the next decades. I don’t disagree that there may be better uses for these resources than burning them though, and I do think nuclear should play a greater role in the generation mix. But current nuclear technology is more suited to baseload operation and even without the supply variability created by renewables, the system still needs to respond to demand variability. The current best technology for this is gas.

I think the issues most commentators here have about greening, which I share, are firstly that the science is far from convincing that de-carbonisation is necessary, and secondly that the approach to de-carbonisation through promotion of renewable generation is expensive and complicated.

The green lobby points out that wind and solar costs are falling impressively, but for the most part they still need subsidies to be viable. These technologies are unreliable in the sense that their output is variable and can be non-existent at times of peak demand – high pressure weather systems in winter, at night-time are the worst scenario for renewables as it’s cold and still (and dark as it’s night) so there is zero wind or solar output.

This then creates two new problems: a capacity problem to fill in these gaps of low renewable output – in the case above the FULL system demand must be met through non-renewable resources, and therefore a lot of additional capacity needs to be available. This capacity won’t be needed when renewables are producing, meaning they also need to be subsidised in order to be economic.

The second problem is that renewable output is variable in real time, making it harder for system operators to maintain system voltage within acceptable tolerance levels. This creates a need for additional frequency control services which again need to be paid for, and makes the whole system much more complicated to manage. This is a flexibility problem.

Policymakers in the UK have talked a lot about the “trilemma” – how to balance de-carbonisation with system security and affordability. They are completely failing on the affordability point, and although system security is better than in Australia, there is definitely no room to be complacent.

I think “sustainability” would be a far more appropriate goal than de-carbonisation. Reducing consumption through efficiency measures and being smarter with consumption through load shifting (DSR) can make a positive contribution and should also have economic benefits.

I do agree with the fiddling while Rome burns comment, and would even say that policymakers/politicians are throwing oil on the fires. In both the UK and Australia some politicians are calling for re-nationalisation of the energy industry, and of course here we have the potentially disastrous retail price caps on the horizon. I think things are going to get a lot worse over the next few years, and expensive electricity may turn out to be the least of our worries….