Last week I took part in a live webcast for the Chartered Institute for Securities & Investment on the subject of energy markets and its intersection with ESG (environmental, social and governance) investing. Here is the presentation I made:

Good afternoon everyone, I’m delighted to be here to share some thoughts on European gas and power markets.

I’m going to begin with an overview of current price trends before going on to explain the physical technicalities of gas and electricity markets and the impact of de-carbonisation. I will finish with some thoughts on the wider ESG perspective for energy investing, ethical supply chains and fairness in the energy transition.

Wholesale prices for both gas and electricity have more than doubled in the past year

The dark green line on this chart is the price of the December 2021 UK gas futures contract on ICE, with the price on the right hand axis in pence per therm. The two lighter lines are the UK power base and peak contracts for December, in pounds per MWh.

There are both supply and demand-side reasons for this price trend…global gas demand fell by 2.1% last year, while producers responded with a 3.1% cut in output. This year demand has recovered, but production has been affected by deferred maintenance, held over from last year, particularly on the Yamal and Nord Stream 1 pipelines and the Norwegian Troll gas field.

There is also speculation that Russia has been restricting flows into Europe as a means of exerting political pressure to get the final approvals for opening Nord Stream 2.

On the demand side, a cold winter last year, particularly at the end of the winter, depleted gas inventories. A heat-wave across much of the northern hemisphere this summer also drove gas demand and as a result gas storage levels were only 75% full at the beginning of the Winter season in October, much lower than normal.

Gas demand in Asia is also high. There is little gas storage in Asia, and demand is less elastic than in Europe where gas-to-coal switching in the power sector can cut consumption. Despite current high European gas prices, un-committed LNG cargoes are still going to Asian markets.

With global production ramping up, the expectation is that going into next winter the market will have returned to balance. In the meantime, the weather will be a critical factor: if the winter is mild and Russian flows increase then pressures will ease, but if the winter is cold, and no meaningful new gas flows from Russia emerge, then the markets will be tight and prices high current high.

Gas prices fell back after President Putin announced that his ministers would explore increasing exports to Europe, but so far these volumes have not materialised. Yesterday the German regulators announced further delays to the Nord Stream 2 approvals process with gas prices jumping on the news.

Whether or not there even is spare capacity for Russia to deliver additional gas depends a lot on the weather.

Under normal weather conditions, Europe should not have issues in meeting gas demand as a rebound in UK and Norwegian production, together with stronger exports from Algeria and Azerbaijan, will increase pipeline supplies compared with the summer. High gas prices are also driving fuel switching from gas to coal and oil in electricity generation, and curtailing some energy-intensive industrial demand.

Assuming Russia uses all its existing pipeline capacity, including Nord Stream 1, Yamal-Europe, TurkStream and the routes through Ukraine up to the ship-or-pay contractual levels, Europe will need around 58 bcm of gas from its inventories to meet demand. This would leave around 29 bcm of gas in storage by the end of March, below the 5-year average but comfortably above historic lows.

However, a cold winter in both Europe and Asia could boost heating demand in Europe up to 20 bcm, and add up to 10.5 bcm of LNG demand across Asia, diverting those volumes away from Europe. There would be a risk that European gas storage would be fully depleted, leaving Europe wholly dependent on higher flows from Russia, above existing pipeline capacity.

A cold winter in Russia would see domestic demand absorbing much of the spare gas capacity, so there would be constraints on both gas volumes and transportation capacity, and security of supply would be at risk. In this case industrial demand could be curtailed.

Electricity prices are being driven by a combination of higher gas prices since gas is the marginal source of electricity generation, and increased carbon prices, as well as supply constraints.

It’s not immediately clear why carbon prices have risen so sharply this year. From a fundamentals perspective, the need for high carbon prices to provide an economic driver for de-carbonisation is not new, but there seems to have been a shift in sentiment that is bringing new money into carbon trading, and it this new interest from hedge funds and institutional investors that has driven prices up, particularly in the first half of the year. Whether this trend is sustainable is unclear, but the pressures on gas prices will sustain higher power prices in even if carbon prices fall back.

In Britain we also have an issue of structurally low capacity margins, which have the potential to threaten security of supply this winter. The GB market has become vulnerable to low wind conditions, and the nuclear fleet is aging with reliability falling faster than expected.

National Grid ESO’s Winter Outlook sees a very low capacity margin of 3.9 GW, or 6.6%, with a loss of load probability of 0.3 hours. This assumes a nuclear availability based on the average of the past 3 years, which may well be optimistic. A month ago EDF had five reactors offline for un-planned maintenance, with a combined de-rated capacity of two-thirds of the winter capacity margin. Today there are four reactors offline, three of which are on planned outages.

It wouldn’t take much for the spare margin to be used up by a higher level of generator outages, another interconnector outage, or even a higher than expected level of exports. National Grid ESO seems confident that interconnectors will be importing when needed, flows in Winter 19 showed Britain was exporting in 18% of all hours and 12% of the hours with the 5% of highest demand. In other words when demand is at its highest, we actually export in almost one out of every eight hours.

While gas prices will likely ease into next year, the dynamics of the power markets will remain challenging for the next few years

The UK’s aging nuclear reactors may well have to close before Hinkley Point C opens in – hopefully – 2026, and all the remaining coal plant is due to close by October 2024. Unless these assets are replaced then the UK is facing tight margins into the medium term, and with them the expectation of high and volatile winter prices.

The reverse is true in summer when high renewables output combined with lower demand is increasingly pushing wholesale prices into negative territory. While this is clearly negative for generators it is not positive for consumers since balancing costs rise dramatically in such conditions due to the increased difficulty in managing system frequency, which I’ll explain more in a moment.

The other important trend is that of electrification – the Government wants to see wider use of electric cars and heat pumps, both of which could see demand on the electricity system almost double by 2050.

Most projections indicate energy prices will rise over the next decade, possibly adding another 50% to current levels. But these price rises will not be uniform: more renewables with near-zero marginal cost means more periods of low or negative pricing.

More price cannibalisation due to low wholesale prices could make un-subsidised renewable energy projects un-viable by the 2030s. At the same time, studies have also shown that despite claims to the contrary, the capex and opex costs of off-shore wind are not falling. This calls into question the future of existing plant as subsidies expire, as well as the chances of financing new projects.

Some analysts expect that by the mid-2030s, negative prices could account for 13.5% of all hours, while at the same time there would be huge price spikes when renewable output is low. These price spikes could account for as many as 9% of all hours.

The physical technicalities of gas and electricity markets and the impact of de-carbonisation

The physics of gas and electricity systems drive their economics in a way which is not the case in other commodities markets.

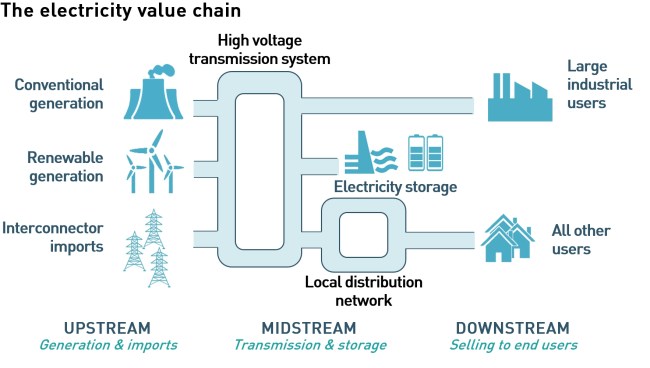

This chart reflects the physical gas system. On the left-hand-side we have the upstream segment, with gas being produced from offshore wells, or imported by ship as LNG, or by pipelines. The mid-stream segment consists of the pipeline network and some limited gas storage, and the downstream segment is distribution of gas to end users.

Gas travels round the system at 25 mph – but for this to happen, the system needs to have sufficient pressure…if there is too little gas in the system the pressure will be too low and gas will not flow to all regions. On the other hand, if the pressure is too high it becomes a safety issue which can lead to explosions. Gas can be compressed up to a point, so the system actually has some embedded storage within the pipes themselves, known as linepack, and there are also some storage facilities in old salt caverns which can cover around 10% of winter demand.

The need to keep the gas system within this pressure range means it is necessary to balance supply and demand in close to real time – the ability to vary the amount of gas in the pipes through adjusting the pressure provides some flexibility allowing the system to be balanced once a day.

If there is insufficient gas, the system operator will buy additional gas to inject in the system or from users who would otherwise consume it, and if there is too much gas, it will pay users to consume more which means prices become negative. Negative prices are rare in the gas market but occasionally it can happen, and gas-fired power stations are paid to fire up to burn excess gas.

The electricity system is much less flexible because there is no equivalent to linepack. Rather than pressure, the constraint in electricity is voltage. Almost all national electricity systems use alternating current, where the frequency of the change in voltage and current comes from the rate at which power station turbines rotate. In Europe the electricity systems operate at 50 Hz with all conventional turbines rotating synchronously at 3,000 RPM (or half that for nuclear[1]). In the US the grid operates at 60 Hz which equates to an RPM of 3,600.

Electricity grids are very sensitive to changes in frequency because electrical equipment will not work if the frequency varies too much. Most equipment connected to the grid has built-in safety mechanisms which will cause it to disconnect if the frequency moves outside a narrow range which can lead to blackouts, so grid operators must carefully control frequency. In Britain, National Grid must keep the frequency within 1% of 50 Hz under the terms of its operating licence.

If supply and demand go out of balance, the frequency will change:

- If the demand exceeds supply, the system frequency will fall

- If the supply exceeds demand, the system frequency will rise

In Britain, electricity demand ranges from about 20 GW on a summer’s night to around 56 GW on a cold winter’s day – a large variation to manage.

Conventional power generators not only set the frequency, but because they are large, heavy objects, they resist changes in frequency, providing what is known as inertia. Problems arise when these conventional generators are replaced with renewable generation which is not synchronised to the grid – clearly solar power has no rotating parts, and while wind turbines rotate, they do so based on wind speeds and therefore not at a set rate.

Most electricity systems cannot operate with more than 75% of electricity coming from non-synchronous sources.

The other problem with renewable energy is that it is unreliable. Clearly solar power is not available at night-time, which in the winter includes the evening demand peak, and wind is unavailable when it isn’t windy. Unfortunately, the weather systems that result in low wind conditions can be wide-spread and long-lasting.

Many people think these issues can be solved with storage, but it is very difficult to store electricity. Norway has a huge hydropower system which currently provides storage services to most of Northern Europe, subject to the capacity of the various interconnectors.

Chemical batteries are also being used. Unfortunately, both hydro systems and batteries are limited in that they can only replace generation for the time it takes for them to run out. For hydro systems that depends on the size of the reservoirs, and for batteries it depends on the time it takes to discharge which is between 1 and 4 hours. In Britain the average is 1.5 hours.

“For one week in mid-February, wind farms generated nearly 40% of Great Britain’s electricity, keeping electricity prices low and reducing carbon emissions. However, two weeks later wind power had almost disappeared, providing just 7% of weekly generation and leading to higher prices,”

– Ed Birkett, Senior Research Fellow, Energy and Environment, Policy Exchange

Last winter we had a period of 12 consecutive days with almost no wind generation – the 1 GW of chemical batteries on the grid was able to provide just 10 minutes of backup for that lost wind. It is simply beyond the capability of current battery technology to balance even the 20 GW of wind we currently have in Britain, never mind the 40 GW that is planned by the end of the decade.

The UK Government plans to fully de-carbonise the electricity system by 2035, subject to security of supply. Unless these challenges of intermittency and inertia can be solved, it will not be possible to meet this target.

Which leads on to the final part of my presentation which is around ethically responsible investing and ensuring fairness in the energy transition

When many people think about ethical investing in energy, they think about moving away from fossil fuels to renewable energy, but this is too simplistic. For example, around 50% of the global supply of polysilicon, a critical component of solar modules, is produced in the Xinjiang region of China, where there are reports linking polysilicon manufacture to the use of forced labour.

Mining and processing of lithium and cobalt for use in batteries creates a lot of water pollution and requires a great deal of water – in South America these activities are leading to disputes over access to water. There are also problems with the use of child labour in cobalt mines in the Congo.

Even on the most ambitious de-carbonisation projections, the world will still require significant amounts of oil and gas in the coming decades, not only for energy but as a feedstock for products such as plastics. Investor activism is beginning to drain capital from E&P activities and forcing the sale of assets by the majors. This is a bad thing – forcing the sale of assets by experienced operators can lead to them being owned by less experienced and less efficient operators, raising prices, and potentially harming the environment.

Higher fossil fuel prices might seem desirable in order to encourage de-carbonisation, but there need to be viable alternatives. Every winter there are thousands of excess deaths in Britain linked to cold homes – if fossil fuel prices rise further more people will fall into fuel poverty and there will be more cold-related deaths. People living in fuel poverty are unable to afford more efficient appliances, better insulation, new windows and shiny solar systems to reduce their energy consumption.

Energy markets are complex, and ethical investing requires trade-offs, balancing the various social and environmental risks and benefits. A genuinely ethical approach to energy investing does not seek to replace dirty air with dirty water, or rely on forced labour or child labour. And it does not increase social inequalities.

There are no simple answers, no “one-size fits all” approach to ethical investing in the energy markets. Investors need to carefully think through the potential impact of their strategies, seek to avoid unintended consequences, and be comfortable with the different possible outcomes if a fair energy transition is to be achieved.

.

.

[1] This is because nuclear turbines operate in a wet steam environment and efficiency is greater at lower speeds (see here for more: https://www.modernpowersystems.com/features/featuresteam-turbines-how-big-can-they-get/)

You are curiously purblind to presume that energy related ESG concepts are entirely about energy generation. In practice, they are far more likely to be concerned with investing in measures that facilitate reductions in consumption. After all, the most environmentally friendly form of energy is almost always the kind you avoid having to use in the first place.

I agree that reduced consumption is important – I was one of two speakers..the other, Stacey Morris, Director of Research at Alerian, had a midstream focus to my more upstream focus. We could have covered a range of angles, but time was limited…

I think that reducing consumption is not a good policy goal because it is too easily met. Simply allow prices to rise and consumption will fall. Likewise “demand response” which requires industrial users to close down is too easy a thing to achieve. I remember Ted heath’s Three Day week.

As you probably know, I am just a consumer, but interested in the overall energy system an how security of supply can be ensured. I deduce (again) from your piece, that energy storage is key. Do you have a view on how storage needs can best be met in the medium to long term?

My own view is that thermal storage both in the home and centrally may be the cheapest option, mainly because they are simple to integrate into existing systems and costs of materials, to me at least, seem low.

Reducing use is helpful, but my own experience of behaviours in the UK, is that insulating existing older stock homes in the UK just leads to homes being kept warmer and consumption staying static. Prices of gas, particularly, need to increase relative to electricity, if consumers are to be encouraged to move to electric heating in the home.

Thank you for providing such an informative and interesting insight into energy markets and systems in an easy to understand form.

Edwin Hogbin should not assume that his own experience of “behaviour in older homes”necessarily reflects overall energy consumer behaviour regarding reducing energy consumption.

In practice overall consumption of natural gas- to date, the dominant British heating fuel- fell by 32% between 2006 and 2019, the latest “normal” year. Simultaneously electricity usage has fallen by 15%.

Government policy regarding the size of the electricity market is still very largely based upon the assumptions underlying the 2006 Energy White Paper, which reckoned that by 2019 we would by now be consuming 30% more electricity than in fact we are.

All this in the absence ,for the last six years at minimum, of any even vaguely coherent energy efficiency policy.

It’s an interesting discussion because when I wrote my series on building energy consumption I found that domestic heating demand has ticked up again in the last few years. This was attributed to a growing tendency to wear fewer clothes indoors, and to heating bedrooms at night with the elderly and young children being advised to sleep in warm rooms (and the increase in people preferring to sleep naked, meaning they need more heating at night.

I think there are interesting opportunities for thermal storage, and of course we need to make buildings more thermally efficient. We also need to reverse the trend of substituting warm clothing with central heating – no-one NEEDS to be in bare feet and shorts in the winter (unless they have already turned off the heating!)

Here’s one investment announcement today:

https://www.scottishpower.com/news/pages/investment_secured_for_whitelee_green_hydrogen_facility.aspx

The best part of £5,000/kW in subsidy for a plant that is likely to be somewhat underutilised, notwithstanding the fact that Whitelee seems to hold the record for hours of receiving constrain payments. I would hope that this gets put under a microscope for the real costs and efficiencies, but I fear it will just become a green totem.

Meanwhile, Bulb has gone out.

https://www.current-news.co.uk/news/bulb-to-enter-special-administration

Too early for the consultation on the cap that OFGEM snuck out on Friday, and so far OFGEM appears to offer no comment on Bulb.

https://www.ofgem.gov.uk/publications/ofgem-consults-adjustments-energy-price-cap

A bit more unravels, even as we start getting cargoes of Yamal LNG into Grain and Milford Haven, partly the consequence of vessels being trapped in unexpected Arctic ice on their way back from the Far East leading to a shipping shortage for longer haul destinations.

Nice discussion of some of the parameters. I suspect you need to re-look at your frequency diagram though: the captioned frequencies are not in order and not quite right (do I detect the midnight oil?), and LFDD starts blacking areas out at 48.8Hz as we know from August 2019. +/-0.2Hz is normal operating range, +/-0.5Hz is normal legal limit, +/-0.8Hz is allowed for up to 60 seconds for exceptional loss of load or supply. LFDD is I think still as per the table here (they raise a nice point about making LFDD more local that actually was demonstrated by the August 2019 blackout)

https://www.westernpower.co.uk/downloads/4093

Actual generator performance is of course also subject to the grid code and somewhat wider frequency limits – in theory. AFAICS this was last looked at in about 2010.

I don’t think Pete Mott begins to appreciate what I am describing when I write about the desirability and opportunities available to continue reducing energy consumption. The sizeable decreases in both natural gas and electricity usage between 2006 and 2019 that I detailed in my last posting (-32% and -15% respectively) were not as a result of closing down business activity, as he infers – indeed UK GDP increased by 80% over that period.

As he seems determined to judge the entire desirability of increasing energy efficiency based upon his experiences in the early 1970s, I would draw his attention to recently published work by Professor Nick Eyre of Oxford University. He has pointed out that between 1970 and 2019 UK GDP increased three times, whilst overall energy usage fell considerably.

I would also remind Kathryn Porter that the majority of energy usage in Britain is not in homes, important as that sector is, but in industry and commerce and in the public sector and in surface transport.

Once again an interesting and well informed post that begins to challenge the widespread group think on the road to zero and raises many issues. One of which is electricity storage.

The public, politicians and academics are being hoodwinked and falsely reassured that the intermittency of wind and solar can be overcome by ongoing storage developments. The huge increase in battery storage is not to cover the situation when wind and solar generation is limited. It serves an entirely different (in fact opposite) and more profitable purpose. It provides to NGSO, at high cost, various specialist technical requirement lacking when wind and solar generation are plentiful.

We will only reach net zero with policy driven by physical technicalities rather than business opportunities. To misquote Gordon Gekko “Green is Good”. The electrical power system is a machine not a reservoir. Every component part including your electric kettle is part of this machine and affects and is effected instantaneously by the whole. If the market does not reflect this we will take the wrong road and spend all our time discussing superficial issues like price caps.

Just a minor correction to your note regarding rotation speed of nuclear power station turbines. Some do in fact operate at 3,000 rpm, notably the gas reactors in the UK. It is usually PWRs that operate at 1,500 rpm in 50 Hz systems and 1,800 rpm in 60 Hz systems.

My comment does not affect the point you make, however.

Yes, I know – I was simplifying…but the link explains more for anyone who is interested. I probably should have qualified the comment…

The zero evangelists need to understand that fossil fuels are a key enable in the green revolution and cutting it down to size too early risks a failure to deliver that revolution and leave the world in a very perilous position that will lead to human catastrophe.