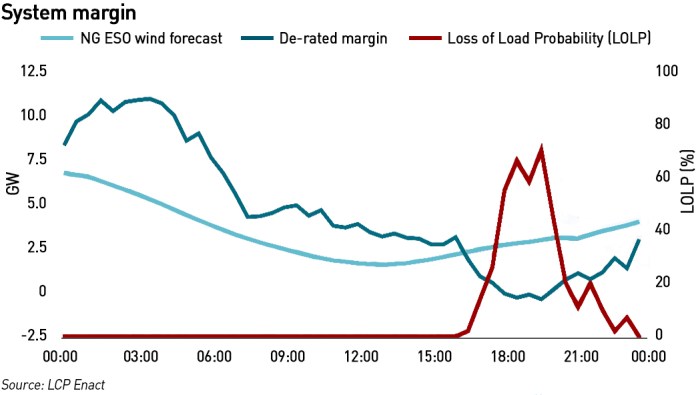

On Monday 18 July, National Grid ESO issued two Capacity Market Notices, the first at for 7pm which was cancelled after about half an hour, and the second for 8pm which was cancelled with fewer than 10 mins to go before the start of the relevant settlement period ie at 7:51pm. The Loss of Load Probability (“LOLP”) reached 70% meaning that the Reserve Scarcity Price, calculated by multiplying the LOLP by the Value of Lost Load which is currently set to £6,000 /MWh reached £4,200 /MWh.

So what happened and why?

Britain, in common with much of Europe, is experiencing a heatwave. This is a high pressure weather system, and these result in clear, sunny weather with low wind output – hot in summer and cold in winter. The UK does not have widespread domestic air conditioning, so unlike countries which habitually experience high summer temperatures, hot weather does not tend to cause electricity demand to spike, and unlike the winter, solar output is strong.

The chart indicates that although demand on Monday evening was higher than for the past 2 years, it was in line with the pre-covid years. In other words, high demand does not explain the system tightness.

Instead, what we saw were inadequate supplies. Summer is when conventional generators carry out regular maintenance – demand and therefore prices are lower in summer than winter so the opportunity cost of being offline for maintenance is lower in summer than winter. Also, there is less likelihood of a system stress event in the summer, so the chances of facing a non-delivery penalty under the Capacity Market would be lower. According to REMIT data available on BM Reports, 12.3 GW of conventional generation (coal, gas, nuclear, biomass and hydro) capacity was offline for planned maintenance on Monday. This was only the second time since the Capacity Market launched that a Capacity Market Notice had been issued in the summer.

According to EnAppSys, “every power station that was available was fully committed to run with additional power brought in on the interconnectors, we even saw the rare sight of all pumped storage units self-dispatched into the wholesale market”.

Very hot weather can also reduce the output of various forms of generation. Solar panels are less efficient when it is hot – they work by using incoming photons to excite electrons in a semiconductor to a higher energy level. When the panel is hot, more electrons will already in the excited state, which reduces the voltage that can be generated by the panel, and also increases electrical resistance in the circuits which convert the photovoltaic charge into electricity.

Thermal power stations also become less efficient since it becomes more difficult to cool them and more energy is wasted as heat – this has been seen with thermal power stations in GB whose maximum output notifications have been lowered as a result. These within-day variations can be seen from the Maximum Export Limit declared in their Final Physical Notifications, for example the MEL for Pembroke Unit 1 varied between 404 MW and 429 MW on Monday, with the lowest value being between 4-5pm which was the hottest time of the day. There are five 440 MW units at Pembroke, so the total reduction across the power station (all units showed similar patterns, and some units actually saw larger reductions) was around 125 MW. Multiplying this effect across the entire thermal fleet would have a very significant impact on output.

Hot weather also increases heat losses in the electricity system. Overhead power lines can slacken and sag with the heat, which increases their electrical resistance, leading to a drop in efficiency. Transformers produce heat when they operate, as temperatures rise they become less efficient, and if temperatures rise too much they become unsafe and can explode. High temperatures also reduce the life of transformers with elevated temperatures being the largest cause of reduced life in transformers.

Looking at interconnector flows we can see that exports to France reduced significantly in the evening. We can also see from interconnector balancing trade data on BM Reports (DISBSAD) that there were significant trades on the interconnectors. The most expensive of these was on Nemo for £2,059 /MWh at 6:30pm. We can see from wholesale trading data that French power prices briefly traded above GB during Monday evening, reducing the drive for exports.

The market has continued to be tight, and while no more system warnings have been issued, interconnector balancing trades today have cleared at even higher prices and by the end of the day, almost £64 million of trades had been executed with the highest individual price being £9,724 /MWh on Nemo.

UPDATE: It appears that these balancing trades on Wednesday were to manage a grid constraint. It was clear at the time of writing that outright capacity was not an issue that day, and various dicsussions I’ve seen particularly on LinkedIn suggest that a grid constraint was responsible.

What does this mean for the coming winter?

These trends are concerning. While in winter we would expect more conventional generation to be available, we would also expect to see higher demand, and while that would see 12:5 GW of plant returning form maintenance, demand could be more than 20 GW higher. The early Winter Outlook is expected from NG ESO imminently, and is expected to show that the capacity margin has collapsed since last year.

The real question will be the extent to which we can reduce exports to France when France will need to rely on imports – while this might be possible for a few hours in the summer, I wonder about the dynamics in winter when low wind conditions over days and weeks could lead to an extended requirement for imports in both countries. With the possibility of reduced imports from Norway, either because system operator Statnett decides to reduce capacity or because Norway runs out of water (hydro levels are close to 20-year lows), the system could be even more stressed than it was on Monday.

For decades we have consistently imported electricity from France – I struggle to see how it would be acceptable for Britain to refuse to export now that France needs imports. There don’t appear to have been any trades between NG ESO and French system operator RTE on Monday, with the interconnector flows appearing to vary based on normal market trading. But under normal market trading, power flows are determined by the short-term price differentials between the markets, moving from the lower to higher priced region. If both countries are short, prices could rise very high.

The dynamics for the winter across the Europe are worrying. Germany is very short of gas and has closed its nuclear power stations meaning it is turning to coal and imports. Norway and France have traditionally been major exporters, but Norway’s hydro levels are already stressed and Statnett has warned rationing may be necessary in southern Norway this winter, while half of the French nuclear fleet is offline. The entire Continent will be very vulnerable to low wind conditions, and since these can extend across several countries at once, the associated difficulties could be very wide-spread.

We can expect to see industrial rationing and even appeals to the public to reduce demand at peak times. And we should keep our fingers crossed that the weather is warm and windy…

Electricity has been below the political and media radar for many years. That is changing rapidly – I can hardly keep up with your excellent posts. Where is all the informed comment from engineers?

With higher volumes of intermittent renewables feasts and famines will be commonplace. No solutions are in sight except vague unquantified statements about storage and inter connectors.

NGSO has set up a 2035 project group led by an ex MP with experience on the board of several renewable energy companies. It is advised by REGEN a consultant specialising in renewable energy. To reassure us all, they recently produced a report ‘ A Day in the Life 2035’. This addresses the famine situation (because it is in the media spotlight) but not the equally problematic feasts. For a winters day famine, by using highly optimistic assumptions not least that inter connectors are entirely at our beck and call and that back up unabated fossil fuel plant is useable, they conclude all is fine but near the knuckle. They mention a week of famine but are silent on the results. They do not mention the feast situation except to say that “ we will inevitably have periods of abundant renewable electricity”. To true with 150 GW of renewables supplying a demand that the report estimates to vary between 35 and 80 GW. Thank god it is dark at night.

“And we should keep our fingers crossed that the weather is warm and windy…”

That last sentence perfectly sums up the folly of renewables

While it is lamentable that politicians have put us in this position – particularly Ed Miliband’s Energy Act 2010 – what really irks me is the attitude of the ESO. For years now the ESO has behaved as though a 100% renewable grid is perfectly feasible and that all it will really take is some incentives so that consumers are “incentivised to flex their demand”. I’m sure the ESO thoroughly understands the issues here, but no doubt there is more money to be made from balancing a renewable grid, but given their role in providing an essential public service I think their behaviour on this is truly despicable – politicians at least have the excuse of being ignorant. I’d say the same about Ofgem, and particularly their new CE Jonathan Brearley, however as a regulator they were effectively “de-fanged” in this role by the aforementioned act.

I’ve been bending everyone’s ear about this slow motion car crash for the last 12 years and my wife always say “well I’m sure the government knows what its doing”!

Its all thoroughly depressing.

Hi Kathryn……thanks for another excellent post.

I confess to being one of those informed & frustrated engineers (now retired) referred to.

Thanks Richard maybe this will serve as a heads up.

Particular reference to the posting https://watt-logic.com/2022/06/24/energy-crisis/ may I quote ?

“So while covid and the war have both been very well publicised, the other pricing dynamic has received much less attention and that is the effect of de-carbonisation. Many people mistakenly believe that renewable energy is cheap and reduces energy prices.

Well, we have been subsidising renewable generation in Britain now for over 20 years, and during that time we have seen a steady increase in end user prices, a trend which is completely different to the behaviour of wholesale prices during the same period”

I would also add the fragnation of ownership of major UK utilities to foreign governments leaving CEO’s as talking heads with nil authority on strategy.

How can a coordinated long term approach be possible with decisions being taken in Paris, Brussels, Berlin, Madrid Sydney, rather than the UK ?

It seems a total betrayal of Margaret Thatchers privatisation programme with the transfer of the ownership of vital energy, transport infrastructure from the UK state to overseas governments control in a matter of a few decades. Sure that Mrs Thatcher didn’t envisage such, leading to the mess we are in now.

Moving on to the global crisis. The french government are about to re-nationalise Electricite de France (EDF) interesting to see what happens here with our ageing fleet of Nuclear plants & the two new builds bearing in mind that the problems currently facing the french national fleet. Then there is the consequence of the German power suppliers EON & RWE cancelling plans for new nuclear plants at Wylfa Anglesey & Oldbury, both ABWR,s of a UK & Watt-Logic favoured design. Sure the cancellation of German nuclear investment by Angela Merkel following the Fukushima incident caused the UK to become collateral damage.

As intimated a middle ranking engineer punching well above my weight on this forum, 5 years heavy engineering, 30 CEGB, 10 years National Grid. In my experience there was little difference between private/public ownership. To be honest I witnessed far more innovation & no nonsense solutions looking down rather than up into the management “club”

Touching on strategic planning the GEGB had a 20 year rolling plan all coordinated, with power plant & network construction/operation/maintenance in house involving some amazing engineers & planners of which I was fortunate to be part of. Admittedly there was a lack of free market discipline & competition in some areas but IMO no different to the private sector I later served in. IMHO in large corporate organisations there will always be sleepy hollows for those who pursue an easy ride.

Barry Wright, Lancashire.

Barry i wouldn’t be surprised to see our entire electricity supply industry re nationalised as its the only way of containing the run away costs in supplying energy that the country now confronts. For all their faults in Germany they at least had the sense to mothball plants not blow them up before the boilers had even gone cold just to allow a politician a photo op to claim they were saving the environment.

Much as it would anathema to your profession I would say we need a decent blackout to wake this country up to how serious the situation is getting.