As we begin to emerge from the covid lockdown there is a lot of talk about a “green recovery” and “building-back green”, with a renewed focus on hydrogen. Last week the Confederation of British Industry (“CBI”) with the University of Birmingham called on the government to ban the installation of conventional gas boilers in homes from 2025 and phasing out all fossil fuel heating systems by 2050. It says that from this date, heat pumps, hybrid systems, and hydrogen-ready boilers should be installed instead.

In its annual report, the Committee on Climate Change (“CCC”) cites hydrogen production and carbon storage infrastructure as one of its five national infrastructure priorities for the next 30 years. A recent report from Aurora Energy Research suggests that hydrogen could satisfy up to half of the UK’s total energy needs by 2050.

National Grid has also got in on the action, stating in its latest Future Energy Scenarios that the fuel will be essential for achieving net zero ambitions:

“Hydrogen and carbon capture and storage must be deployed for net zero. Industrial scale demonstration projects need to be operational this decade,”

– National Grid, Future Energy Scenarios 2020

Last month, the Government held the first meeting of a new Hydrogen Advisory Council, while announcing investment to support the development of new low carbon industrial clusters. The council will act as the “primary forum” for engagement between the Department for Business, Energy & Industrial Strategy (“BEIS”) and representatives from the sector, and will consider the relationship between production and end use. The £139 million Industrial Decarbonisation Challenge funding is available for 12 projects in Merseyside, the Tees Valley, Humber, South Wales and in Scotland.

“Hydrogen and CCUS are a part of the bigger Green Recovery. If government invests in low carbon energy technologies and businesses, we are confident that it will massively benefit the economy, environment and society,”

– Emma Pinchbeck CEO, EnergyUK

Energy Systems Catapult agrees. In its recent report Innovating to Net Zero, it says that in order to achieve net-zero ambitions:

“With few exceptions, final energy must be delivered by vectors that are zero carbon at point of use, i.e. electricity, hydrogen and district heat. By 2050, a new low carbon hydrogen economy will need to be created, delivering up to 300 TWh per annum, roughly equivalent to electricity generation today.”

When I last wrote about this topic in 2016, I concluded that the challenges were significant, and I have been consistently bearish ever since. In this post I will review the current state of play and its prospects within the energy system, to see whether the outlook has improved.

Why is hydrogen attractive?

Hydrogen is the most common chemical element in the universe, making up 75% of all normal matter by mass. Pure hydrogen is normally made of two hydrogen atoms connected together. Scientists call these diatomic molecules. Hydrogen will have a chemical reaction when mixed with most other elements, and is therefore rarely found in its natural state, being most commonly present in the form of water (chemically bonded with oxygen).

Hydrogen can be extracted in two main ways. “Green hydrogen” is produced by the electrolysis of water, whereas “blue hydrogen” is formed by the degradation of methane.

The benefits of green hydrogen over blue hydrogen stem from its lack of unwanted bi-products; green hydrogen has only oxygen as a bi-product, but blue hydrogen also produces carbon dioxide (CH4 + H2O ↔ CO + 3H2 then CO + H2O ↔ CO2 + H2O).

The problems with green hydrogen are that it’s expensive to extract, transport and store, so it will struggle to be competitive. Blue hydrogen has problems of its own, in addition to the shared problems of cost transport and storage; it’s dependant on natural gas, and requires carbon capture storage (“CCS”) which is yet to emerge as a proven commercial technology (see below).

Potential applications for hydrogen

There are many potential applications in the transport sector

The UK has legislated to end the sale of new internal combustion engine vehicles in 2035, creating a need for low carbon modes of transport. Electric vehicles have grown in popularity, but are less suitable for heavier means of transport. The key challenge relates to energy density – the need to move heavy boats or aeroplanes while transporting the relevant fuel on board, means the fuel must have a high energy content but a small physical volume and low mass.

Governments around the world are trying to incentivise manufacturers and consumers to enter into the hydrogen fuel cell market through use of grants and other incentives, while also committing to increase the necessary infrastructure – Germany is planning to build 500 more hydrogen filling stations, while Japan already has 81 stations open, with more to come.

In the car and light van segment, electric vehicles might remain ahead

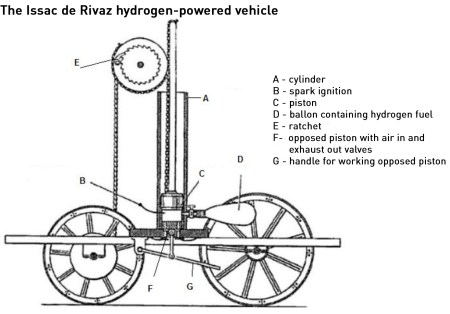

Although electric cars have quickly gained popularity, they currently still only have about 1.6% of the market for new cars in the UK. Hydrogen-powered cars have been around for longer – in fact the very first four-wheel vehicle with an internal combustion engine ran on hydrogen and oxygen in 1807, with the hydrogen stored inside a balloon. The first practical hydrogen fuel cells were created in 1932 by Francis Thomas Bacon and used by NASA. The first commercially available hydrogen cars were developed by Hyundai – the Tuscon FCEV, introduced in 2013, but have failed to gain traction due to lack of supporting infrastructure. Now a group of car makers including Toyota, Daimler and BMW is investing US$10 billion over the next 10 years to develop hydrogen technology and infrastructure.

With the drive to de-carbonise transport, the use of hydrogen is again under wider consideration. In 2017, the UK Government announced a £23 million fund to “accelerate the take up of hydrogen vehicles and roll out more cutting-edge infrastructure”: there are currently only 13 hydrogen stations in the UK.

One benefit of hydrogen is that it can be produced on site rather than being transported like hydrocarbon fuels, or supplied through the grid like electricity. The Wiltshire town of Swindon has the UK’s first fully renewable hydrogen station which opened in 2011, in a Honda dealership. The station produces hydrogen on a commercial scale using solar power, without relying on the electricity grid. Car leasing firms such as Arval, operate hydrogen cars in the city, leading the council to install a second hydrogen station. Arval plans to have 170 hydrogen cars in the town by the end of 2020.

But even with hydrogen infrastructure in place, hydrogen vehicles still face the challenge of high costs: the Toyota Mirai retails from £61,500 after the current £4,500 Government grant, which is a lot to pay for a car – the hybrid Toyota Prius has similar features but is listed from only £24,875.

There are two possible ways to address this issue. The first is the typical one where costs fall as technologies develop. In the case of Toyota, as the cars are built on a modular platform, so replacement of the drive train from petrol to hydrogen is not difficult. The other approach involves a more radical change in the business model around car use, moving from an ownership model to a service model where miles of hydrogen driving with fuel and insurance costs are bundled and bought by customers, rather than simply buying a car. This involves taking the current popular finance-leasing models a step further.

However, as the EV charging infrastructure is more extensive and with hydrogen cars being so much more expensive, there is a long way to go before hydrogen could overtake EVs in the low-carbon car market.

Hydrogen is more suited to the heavy vehicle segment

Manufacturers are responding to the challenge of de-carbonising road freight – Hyundai, Toyota, Mercedes-Benz and Ford are all exploring hydrogen propulsion for trucks, while also working on fully electric heavy vehicles. Hyundai has already sent the first 10 fuel cell electric trucks to Switzerland out of the 1,600 which it plans to have sold by 2025.

Hydrogen has a number of benefits over electricity for heavy vehicles:

- less time is taken to re-fuel than to re-charge the batteries – a major consideration in time-sensitive logistics operations;

- the amount of batteries needed to propel a heavy vehicle has a higher weight than the hydrogen equivalent, resulting in lower energy efficiency;

- hydrogen has a range similar to the current diesel stock, much further than the current range for battery-powered trucks.

However, there are also disadvantages:

- hydrogen is much more expensive than electricity;

- there is little infrastructure for hydrogen, while increasing numbers of battery charging points are being built.

Bimodal hydrogen-electric trains could drive diesel off the railways

The University of Birmingham and Porterbrook, a rolling-stock company, are developing a train that uses hydrogen and oxygen to produce electricity, water and heat. Hydrogen trains have been pioneered in Germany, and the Hydroflex project aims to bring the technology to the UK. It is not possible to use the same trains as Germany since German trains are taller and will not fit beneath British railway gantries and bridges. Smaller trains have less space on board to accommodate the technology – the challenge is to design trains with space for enough hydrogen to last for an entire day. The German trains have fuel cells in the roof and the batteries underneath the train.

The Hydroflex train has been designed to run either on hydrogen or electricity supplied from external power lines making them a potentially practical replacement for long-distance diesel trains. Diesel trains still make up 25% of the UK’s rolling-stock, which the Governments wants to phase out by 2040, but this is challenging since more than two thirds of the rail network does not have the overhead cabling needed to run electric trains.

Last month, the project secured a £400,000 grant from the Department for Transport to help it develop the detailed final production design and testing for its hydrogen train. Full trials will start within weeks and it could pull passenger trains late next year. The trial will take place from the group’s base at Long Marston, Warwickshire, and run on the North Cotswold Line, from Oxford to Hereford.

Hybrid hydrogen solutions may be viable for smaller ships

Viking Cruises is planning to develop the first hydrogen-powered cruise ship, which will be around 230 metres long and will accommodate more than 900 passengers and 500 crew. Competitor Royal Caribbean Cruises has entered into an agreement with shipbuilder Meyer Turku to develop ships fuelled by liquified natural gas (“LNG”). In Norway, a consortium of power generator BKK, Equinor and Air Liquide is working to develop a full-scale national hydrogen infrastructure to support the de-carbonisation of the Norwegian maritime transport sector. The Energy Observer is a small vessel powered by solar energy and a hydrogen fuel cell.

Larger shipping would require bunkering with liquid rather than gaseous fuel since it gives more range or longer times between refuelling than gas. The difficulty with hydrogen is that it has an energy density by volume which is only around 40% of that LNG, meaning the fuel will take up more on-board space, reducing space available for cargo. This will be particularly challenging for longer voyages, such as the 40-day Asia-Europe route. Hydrogen also requires much more energy to liquify than for LNG. LNG has a further benefit of having been used for many years in the propulsion of LNG tankers which now run on the boil-off from the cargo.

Despite these challenges, some companies are progressing with the development of hydrogen-powered shipping. Kawasaki Heavy Industries has launched the world’s first liquefied hydrogen carrier, developed to transport liquid hydrogen at -253oC in large quantities over long distances, but it remains to be seen whether hydrogen would be suitable as a fuel for heavy shipping, or whether LNG will be preferred.

Many obstacles must be overcome before hydrogen can be used in heating

The de-carbonisation of heating is a major challenge, and another area where hydrogen is mooted as a potential solution. The most straightforward way forward is by blending it with methane in the natural gas grid, and there are already projects exploring this option.

Some, such as the CBI, as noted above, propose a more aggressive move towards the use of hydrogen for heating, recommending that “after 2025 all new domestic boiler installations must be part of a hybrid system or be ‘hydrogen-ready’. By 2035 no new natural gas burning boilers or systems should be installed and only net-zero compatible technologies like air source or ground source heat pumps, hydrogen burning boilers or heat networks should be deployed.”

The first part of this seems overly optimistic, since there is currently no consensus that the use of hydrogen on homes can be done safely, or that hydrogen can be produced at scale in a zero-carbon way.

“The [CBI] report makes some very sensible suggestions but I’m a little surprised by the suggestion that from 2025 all new boilers must be part of a hybrid system or hydrogen ready. This seems to suggest that gas boilers can simply be replaced when actually much more fundamental changes are required for net-zero. Until we know if hydrogen offers any value for domestic heating, we should be planning for a world where burning fossil fuels for heat is replaced with known low carbon technologies such as energy efficiency, heat networks and heat pumps,”

– Richard Lowes, energy specialist at the University of Exeter told the Telegraph

The idea of replacing methane for hydrogen is appealing in its simplicity, but it is far from simple in practice, and the steps to achieving this are extremely unlikely to be in place in the next 4.5 years as required by the CBI. No household will install a hydrogen-ready boiler unless there is certainty that hydrogen will be delivered through the gas grid.

Other approaches might achieve significant de-carbonisation of heating without the need for such leaps of faith. Heat pumps, hybrid heat pumps and micro combined heat and power systems can all significantly reduce emissions related to space and water heating. Given the diversity of existing housing stock it is likely that a diversity of solutions will be required, and there will be no one size that fits all.

Use of hydrogen in industry shows potential, but only alongside CCS

Given existing uses of hydrogen for industrial applications, extending this to energy might be an obvious first step, however, CCS would be essential to secure the volumes required. One model currently under consideration centres on the use of clusters of multiple industrial clusters, integrated with domestic use and transport. A number of local hydrogen initiatives is underway in the UK, but all are still in the very early stages.

HyNet, located in the North West of England and includes the production of hydrogen from natural gas, alongside the development of a new hydrogen pipeline and the creation of CCS infrastructure. Local industrial energy consumers including Unilever, Pilkington and Essar are exploring the viability of converting their processes to run on hydrogen, while gas network operator Cadent is working on the design of the hydrogen distribution network.

The Tees Valley Hydrogen Innovation Project aims to support small and medium sized businesses in the Tees Valley to stimulate the development of a hydrogen low-carbon economy.

Drax, Equinor, National Grid and eight other companies are collaborating on a zero carbon cluster in Humberside, and are exploring the potential development of a large-scale hydrogen demonstrator scheme by the mid-2020s, and the creation of a hydrogen economy across Yorkshire and the North of England, including a large scale CCS network and a hydrogen production facility.

A new hydrogen initiative, Hydrogen East launched in July in East Anglia, comprising Arup, Opergy, New Anglia Energy, EDF Energy and the New Anglia Local Enterprise Partnership.

Hydrogen is not without problems

High cost of production: According to the Financial Times, there is a reason that hydrogen accounts for just 4% of final energy use at present: it’s expensive. Hydrogen is currently costly to produce: US$ 1/kg for methane reforming and US$ 6/kg for electrolysis powered by offshore wind which equates to US$ 270/bbl of oil on an energy-equivalent basis. The minimum cost for electrolysis once production experience increases and efficiencies are delivered is around US$ 1/kg which is equivalent to US$ 45/bbl for oil, before storage and distribution costs. Hydrogen is also bulky, making it difficult and expensive to handle and store once produced.

High cost of implementation: There is currently very little hydrogen infrastructure in place. The creation of a “hydrogen economy” would require major infrastructure investments to deliver hydrogen to the point of use. Domestic applications would require complete conversion or replacement of appliances since existing gas boilers, heaters and cookers cannot operate with hydrogen.

New hydrogen sensors and meters would be required in every building using hydrogen. (Natural gas consumption in the UK is measured using flow meters. As hydrogen has different flow properties and a different volumetric energy content to natural gas, existing flow meters are not considered suitable for measuring hydrogen consumption.)

For the safe handling of hydrogen, stronger tanks are needed than for gasoline for example. The IEA estimated that a the cost of a hydrogen tank for a car would be around US$ 3,000-4,000 while an equivalent petrol tank would cost just US$ 500-1,500. Subsequent work suggests a fall in costs of around 12%, but that still results in a significant premium to a petrol tank.

CCS is currently un-economic: Large-scale use of hydrogen is almost certainly going to require carbon capture and storage capabilities. Commentators are keen to point out that there are now increasing numbers of large CCS projects in operation around the world, but scratch the surface, and you find that every single one of these relies on hydrocarbon fuel production for its economics. In the absence of hydrocarbon fuels, this technology is not currently economically viable, and would require significant subsidies in order to gain traction.

Safety: Hydrogen is colourless and odourless making leaks difficult to detect. It is highly flammable and will burn in air at a very wide range of concentrations between 4% and 75% by volume, and it forms explosive mixtures with air in concentrations from 4–74%, meaning the consequences of un-detected leaks can be catastrophic (for example the famous Hindenberg disaster). It can react spontaneously and violently at room temperature with chlorine and fluorine to form the corresponding halides, which are also potentially dangerous acids.

Hydrogen is inherently more dangerous than both methane and gasoline, which are less prone to leak, have higher ignition energies, smaller ignition concentration ranges, and smaller detonation ranges. Hydrogen molecules are also smaller than methane molecules, so existing infrastructure would need to be tested to make sure it was impermeable to hydrogen, not just in the pipes – the lead mains replacement programme is almost complete – but also in all joints and connections particularly in homes.

Water consumption: The conversion of methane to hydrogen through steam methane reforming consumes significant amounts of water. The estimated amounts vary however, taking the CCC’s projected hydrogen requirements, this could equate to a UK water consumption of between 67 billion and 140 billion litres per year which is equivalent to 1-2% of the UK’s current annual water consumption.

While this might seem manageable at a national level, there could be local difficulties, particularly as local water shortages currently occur, and drier winters can lead to restrictions on summer water consumption. Given the logistical challenges with the transportation of hydrogen, location of hydrogen production would need to take account of the availability and security of water supplies.

.

Despite these challenges, it is difficult to find dissenting voices. One is Tom Baxter, Senior Lecturer in Chemical Engineering, University of Aberdeen, who argues that other pathways to de-carbonisation make more technical and economic sense. He points out that the recent report from the All Parties Parliamentary Group hydrogen was sponsored by businesses with a vested interest in promoting hydrogen: domestic gas boiler providers, gas network operators and fossil fuel producers who know that for the foreseeable future, hydrogen will be fossil derived.

“Much of my 45-year career in industry and academia has been spent studying energy efficiency and power production and supply. I believe that hydrogen has a limited role in decarbonisation, and that businesses with a vested interest in promoting hydrogen are doing so at the expense of British consumers,”

– Tom Baxter, Senior Lecturer in Chemical Engineering, University of Aberdeen

He also argues that the fuel is inherently inefficient for transport applications since the energy must move “from wire to gas to wire” in order to power a vehicle. Electricity generated from a renewable source such as wind power is used to produce hydrogen is a process that is around 75% energy-efficient. The gas is then compressed, chilled and transported to the fuel station, a process that is around 90% efficient.

Once inside the vehicle, the hydrogen needs to be converted into electricity, which is 60% efficient. Finally, the electricity used in the motor to drive the vehicle is around 95% efficient. This leads to a round-trip efficiency of only 38%. On the other hand, the electricity for charging electric cars only loses around 5% in transmission from the generator to the charging point, and further 10% is lost through charging and discharging the lithium-ion battery, and another 5% to drive the vehicle. This gives an overall efficiency of 80%.

John Constable of the Global Warming Policy Foundation believes that the high costs of using hydrogen safely would not be justified by the economic benefits:

“In the longer term, there must be some doubt over whether a renewables-fuelled hydrogen economy can generate the wealth required to support the technologies and practices require to contain the risks of hydrogen use. Neither gasoline nor electricity are cheap to use safely, but the great wealth created by fossil fuels makes the required safety measures easily affordable. It is not clear that the same can be true of a wind-or solar-powered system using hydrogen as its energy carrier.”

Why is hydrogen suddenly attracting so much attention?

The answer to this question lies squarely with political ambitions, since there are limited ways in which an economy with net zero carbon dioxide emissions could possibly be achieved. Natural gas currently provides heating and cooking to 23 million British homes, with households accounting for 40% of all natural gas use in the UK – a fuel that could replace natural gas on a “plug-and-play” basis would be hugely appealing.

As John Constable says in his 2020 report for the Global Warming Policy Foundation:

“International enthusiasm for a shift towards a hydrogen economy has never been stronger. However, this interest is not grounded in any recent technological breakthrough, but in the inexorable logic of current climate mitigation ambitions. Current policy sees in hydrogen a universal free parameter, offering the possibility of decarbonising otherwise extremely difficult sectors in line with the objectives of the Paris Agreement.”

He also points out that investment in these initiatives has been lower in recent years than it was a decade ago, with only China showing meaningful growth.

One comment in John Constable’s report stood out: that the costs of achieving net zero described in the Committee on Climate Change’s report “are well in excess of most estimates – even extreme ones – of the social cost of carbon, meaning that the policies required are more harmful to human welfare than the climate change they aim to prevent.”

This high cost, and the technical barriers to the wide-spread deployment of hydrogen to support de-carbonisation are also described in the Aurora Energy report mentioned above:

In a nutshell, this is the problem with a lot of current environmental policies – the pursuit of net-zero carbon dioxide emissions regardless of the economic costs, which may very well exceed the harm from emissions in the first place. Hydrogen may be big news at the moment, but noise does not necessarily translate into meaningful action. Over the past 20 years there has been significant enthusiasm about CCS, but that has failed to reach affordability other than in the very narrow case of hydrocarbon fuel production, which does not bode well for the prospects of wide-spread use of hydrogen.

The enthisiasm for hydrogen seems to be strongly linked to the growing realisation that net-zero commitments will be impossible to achieve without a new, transformative technology, but the desire for such a thing, however strong, does not necessarily translate to its deliverability. It remains to be seen whether hydrogen intiatives will result in genuine solutions to this problem, or whether they will remain just so much hot air.

.

This post was co-written by Adam Porter.

Is hydrogen being over-sold rather like diesel was. Hydrogen plus oxygen produces water only, fine, but hydrogen plus air might not be so benign. Get a fuel- (hydrogen) rich mixture and the nitrogen in the air could produce ammonia (NH3). Get the fuel (hydrogen) lean and the nitrogen in the air could produce nitrogen oxides, just like the combustion of fossil fuels does.

Has anyone analysed the exhaust from fuel cells for ppm products where air has been used?

A very good summary

An interesting summary, thank you. As someone with a PhD in Chemistry, I will say that the fears around the chemical safety of hydrogen are out of proportion and over-simplistic (re: D. Hawthorn in particular). As a society we have long mastered bulk chemical reactions involving hydrogen and we are pretty good at it. The edge of science has now moved on to nano chemistry (basically single atom chemistry), well beyond the sophistication we need to handle bulk hydrogen in a bottle. With regard to the economics, it’s hard to know if hydrogen is ‘value for money’ in the net-zero challenge. However, I believe that regardless of our climate change obligations we as a society will eventually chase down the use of hydrogen as a fuel, wether it happens in the next twenty years or the next fifty because it is so useful.

I liked the blog article.

It is interesting in many ways – including the noting of the vested interest promoting a sort of myopia (not considerate of alternatives or some of the issues)

I do have issues with some of the lobbyist sound bites.

“zero carbon at point of use”; a bit of a slight of hand and rules out, for example (amongst others) methane made from captured carbon (which would be more beneficial) – which would eliminate many of the difficulties of storage and distribution, almost at a stroke.

Also.

Hydrogen is known to have issues with much metallurgy – causing hydrogen embrittlement (which is why, for example, the SABRE jet engine uses helium to exchange the heat from hot, incoming, air to its liquid hydrogen fuel) – and would be required for all storage, distribution and application equipment.

Other technical issues are centred around the low VOLUME density of hydrogen; there is a need to keep it cold (increases its density) and under pressure (increases its density); this is required to be affordable and applicable to small sizes (to fit in a car, for example).

Technical need to be considered properly – but, until then, I am not sure that pilot projects are the best use of funding.

Thank you for this informative article

Adam, your article was very informative! Hydrogen is the fuel of the future. It has shown great promise in replacing our current reliance on fossil fuels. It is a dependable, easy-to-manufacture, and environmentally friendly fuel. Although the cost of production and implementation remains high, I believe that with new research, government incentives, and mass production, these shortcomings can be easily overcome in the near future.