Access to finance is important to businesses at any time, and more so in these times of unprecedented disruption. One area that has been attracting increasing levels of interest in recent years is the area of green finance, where issuers raise money in the bond or loan markets to finance climate and environmental projects.

Sustainable or “green” bonds are often asset-linked, and backed by the issuing entity’s balance sheet, so they generally carry the same credit rating as their issuers’ other debt obligations. They will generally have covenants containing environmental targets and sometimes the coupon is linked to environmental performance as described by certain environmental, social and governance (“ESG”) criteria.

Strong growth in green bond issuance

According to the Global Sustainable Investment Alliance, BlackRock, the world’s largest asset manager, expects that ESG exchange-traded funds assets will hit US$ 400 billion by 2028. Much of this is being driven by regulatory pressures: in a survey by State Street, 52% of European investors cited getting ahead of regulation as the key reason for adopting ESG, with mitigating risks coming a close second.

Before the extent of the Covid-19 crisis became apparent, sustainable bond issuance was forecast to continue on its recent trajectory with 2020 expected to be another record year.

2019 saw companies, financial institutions and governments raise a total of US$ 185 billion to fund environmentally sustainable projects according to analysis by law firm Linklaters.

“Since first appearing in 2007, the market for green bonds has attracted significant interest in recent years as sustainability issues rise up the corporate agenda, following pressure for companies to reduce their environmental impact, and following the introduction of increased regulation in the area. 2019 saw a total of 479 green bonds issues worldwide, up by a quarter compared to the previous year,”

– Amrita Ahluwalia, Capital Markets lawyer, Linklaters

Just over 40% the amoubt raised in the green bond market originated in China, the USA, France and Germany. However, the country issuing largest number of green bonds was Sweden, with 78 issued in 2019 and over 230 since 2015. This reflects high levels of climate awareness in Swedish society, where local government agencies were key participants in the market with substantial investments being made in green infrastructure.

Historically, the sustainable bond market was dominated by surpra-national and quasi-sovereign issuers, however with the emergence of a more rigorous framework around the definition of green bonds – the Green Bond Principles from the International Capital Markets Association – as well as the increased focus on climate change, both corporates and financial institutions are gaining market share. In 2018 and 2019 around half of all green bond issuance came from either corporates or financial institutions.

In Europe eligible projects for green bonds include renewable energy, energy efficiency, pollution prevention and control, eco-efficient and/or circular economy adapted products, production technologies and processes, green buildings, terrestrial and aquatic biodiversity conservation and clean transportation initiatives.

Energy companies tapping the green bond market recently include National Grid with its inaugural €500 million green bond issue in January; E.On with a €750 million sustainable bond in April; and Cadent, with a 12-year, €500 million bond to fund its iron mains replacement programme.

National Grid’s green bond will finance electricity transmission projects with an environmental benefit, following the guidelines set by the International Capital Markets Association Green Bond Principles. Projects could include funding the connection infrastructure of wind farms to the grid, investing in projects that would reduce electricity grid losses, financing clean transport infrastructure, such as the electrification of railways, or substituting overhead lines for underground cables.

E.On said that despite the significant market disruptions caused by Covid-19, it secured favourable interest terms and significant investor demand meant the issue was 8 times over-subscribed. This deal followed E.On’s inaugural green bond in August 2019 when E.On issued two tranches of €750 million each.

Cadent’s bond was the first “transition bond” – a new type of instrument intended to help organisations decarbonise their operations – to be issued in the UK. Although the primary aim of the programme related to safety improvements, the replacement of iron mains will reduce methane leakages and allow the pipes to carry hydrogen in future. Unlike plastic pipes, iron pipes can become brittle as hydrogen molecules are absorbed into the metal, making them weaker.

Green bonds outperforming regular investment grade issuance during the current crisis…

UBS Global Wealth’s head of credit, Thomas Wacker has suggested that sustainable bonds are a “defensive opportunity” that credit investors should favour over non-green, investment-grade corporate debt. He told Bloomberg that many of the industries most impacted by the effects of Covid-19 and the oil price slump do not typically issue sustainable bonds, which are more common in more conservative sectors such as utilities, banks and, to a lesser extent, cyclical industrials.

Sustainable bonds tend to have tighter bid-offer spreads than non-sustainable issuance from the same borrower, something that continues to be the case in the current market. While risk premiums have widened significantly for both types of securities, the effect has been less pronounced for sustainable debt (2.5% so far this year compared with 5.1% for the investment-grade, corporate debt benchmark). In addition, investors that own sustainable bonds tend to hold on to them when selling down a portfolio because of their scarcity.

Wacker went on to say that he didn’t expect green bond issuance to be significantly hurt by the current volatility because the borrowing tends to be linked to specific project, citing Consolidated Edison Inc which issued US$ 1.6 billion of sustainable debt in late March to fund new and existing expenditures.

His argument is that plans to develop a large windfarm for example would not be particularly affected by the current crisis since they are large, long-term commitments. I’m inclined to disagree in that many construction projects are currently on hold due to supply chain disruptions, lower worker availability, and the challenges of social distancing for example on supply ships for offshore projects. While shovel-ready schemes may return quickly after the various global lock-downs are eased, it is hard to argue that they are not currently being affected.

…however over the results are otherwise mixed with strong regional differences

Recent research from HSBC indicates that the shares of companies focusing on climate change or ESG issues have outperformed in Europe and Asia but underperformed in EMEA and the Americas as Covid-19 has spread. The current crisis is having a significant economic impact as heavy industry, non-food retail and the hospitality industries are largely shuttered, and businesses that are able to continue operating scrambling to adopt new modes of working that were never envisaged in even the most thorough business continuity preparations.

This all brings additional focus on balance sheet strength and good financial governance – anecdotally, in the run up to the lockdown, businesses were scrambling to draw down on their bank facilities in order to secure liquidity.

HSBC found that shares in ESG-aware companies outperformed – although there are some big regional differences. They analysed 613 shares of global public companies valued at over US$ 500 million where climate solutions generate at least 10% of revenues, plus the 140 stocks with highest ESG scores and values above the global average. They looked at performance between 10 December 2019 (the start of the crisis) and 23 March 2020, and from 24 February, when high volatility began.

Climate-focused stocks outperformed others by 7.6% from December, and by 3% from February. The ESG shares beat others by about 7% for both periods. In the Asia-Pacific region, climate shares outpaced 13.6% since 10 December and 5.6% since 24 February. In Latin America the figures were 12.8% and 5.7% respectively, and in Europe these shares outperformed since December but underperformed since February.

However, climate stocks in the Middle East and Africa underperformed the region by 0.3% since December and 0.9% since February, and in North America the underperformance was 1.9% and 6%.

ESG companies also outperformed in Europe and Asia but underperformed in the Americas.

“We think investors should consider how well companies manage these ESG risks. They should use ESG analysis to consider whether estimated earnings growth is still realistic, what increasing volatility means, whether to change risk premia – and what are the best-case, worst-case, and highest-likelihood scenarios,”

– HSBC Research

HSBC’s core ESG conviction is that these issuers succeed over the long-term, and deliver shareholder returns when they create value for all stakeholders: employees, customers, suppliers, the environment, and wider society. When a crisis like Covid-19 occurs, with social and environmental causes and effects, investors could see ESG as a defensive characteristic.

Importance of reliable data

However, a sustainable investment strategy is only as good as the data on which it is based. There is large number (c 200) of ESG data providers, which are not consistently reporting the same information. The two largest ESG data providers, MSCI and Sustainalytics, have a correlation of just 0.5 on their ESG data scores.

“Because there are so many data providers [with such varying scores], investors are able to find one that rates the sustainability of a company, even if the others do not. It is like having no ESG ratings at all,”

– Gianfranco Gianfrate, professor of finance at EDHEC Business School

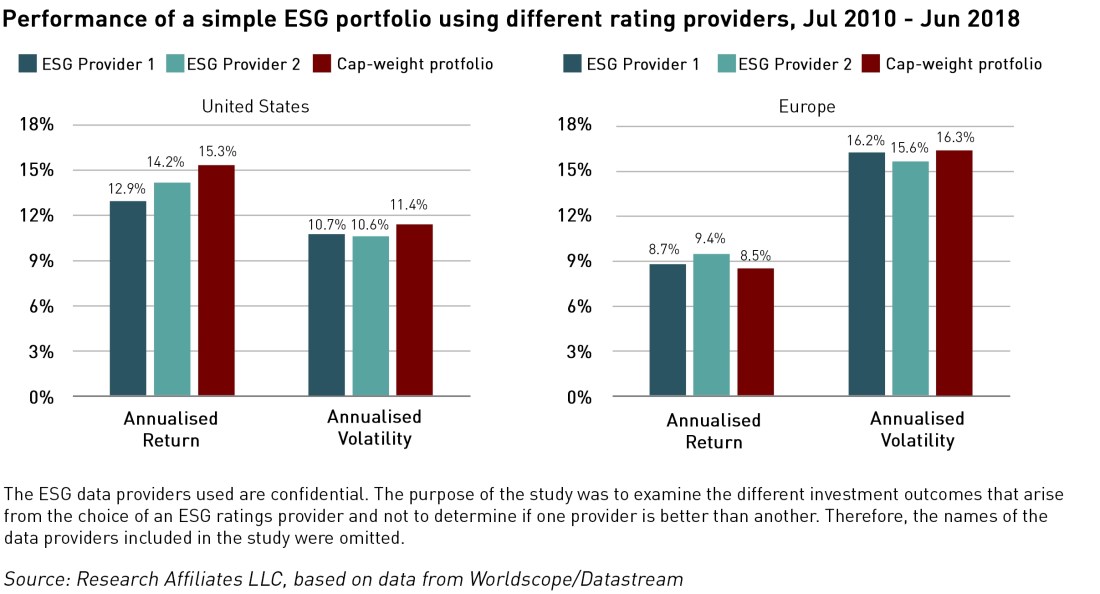

US investment firm Research Affiliates has dug deeper into this and found that between July 2010 and June 2018, two notable ESG portfolios had a performance dispersion of 70 bp per year in Europe and 130 bp a year in the US, translating into a cumulative performance difference of over 10% and 24% respectively. As much of this data is derived from self-reported sustainability performance by companies, there are concerns that the sustainability being reported is not entirely genuine. A November 2019 report by SCM Direct found that several ESG products had significant exposure to companies in tobacco, gambling and alcohol sectors.

In an effort to address concerns over greenwashing, the European Commission has published final report on its taxonomy for sustainable finance, to help both companies and investors to determine which activities qualify as sustainable, with an aim to steer private capital to more long-term sustainable activities.

The EU Taxonomy, developed by the EU’s Technical Expert Group on Sustainable Finance (“TEG”) sets performance thresholds (referred to as “technical screening criteria”) for economic activities which:

- make a substantive contribution to one of six environmental objectives;

- do no significant harm to the other five, where relevant;

- meet minimum safeguards (eg OECD Guidelines on Multinational Enterprises and the UN Guiding Principles on Business and Human Rights)

The document also addresses the requirement to stop financial companies from disguising themselves as sustainable when they are not, and businesses will be required to show the extent to which their financial products align with the taxonomy.

.

Against the backdrop of the Covid-19 crisis, many companies will be facing liquidity challenges. Those businesses and financial institutions that have viable environmental projects of a sufficient size and scale could see specific green bond issuance as a more attractive means of raising finance than other potential sources. But the bond markets are not for everyone – borrowers will still need to have a decent credit rating and be looking for sizeable amounts of finance. Bonds markets are significantly less flexible than the bank market when it comes to covenant flexibility, so borrowers need to be cognisant of that when tapping the markets in times of high volatility.

This means that green bonds can be an attractive option for larger companies such as National Grid, but will be beyond the reach of the many new entrant suppliers that are likely to be facing liquidity constraints as this crisis persists.

Sustainable finance is one of those expressions you just know is an oxymoron. These scams depend entirely on rigged markets for so long as governments can afford to rig them. Present circumstances have shortened the period for which they will be able to do so.