The past few weeks have seen unseasonably cold weather in the UK – we even had a dusting of snow in London(!) – which has inevitably put pressure on energy supplies, particularly against the backdrop of the Rough closure. Gas demand rose to its highest levels since 2013, and markets were further stressed in the past week by a number of gas infrastructure incidents.

Pipeline cracks close the Forties system

On Monday, Ineos announced that it was reducing flows on the Forties pipeline system in the North Sea was being was shut down for emergency repairs following the discovery of a crack. The pipeline, which carries 40% of North Sea oil and gas, is expected to be closed for between two and four weeks while repairs are carried out.

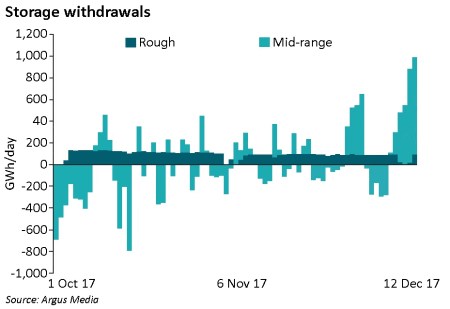

North Sea gas production has subsequently fallen 35%, with medium-range storage meeting the shortfall – on Tuesday storage send-out reached a record high of 75mcm – around 5% of the UK’s total gas reserves.

“The European gas market seems to be going through a perfect storm…If supply does not resume soon and the cold weather continues, prices will remain strong through the winter,”

– Massimo Di-Odoardo, analyst at Wood Mackenzie.

Oil prices also surged, with Brent crude rising above US$65 / barrel for the first time since June 2015, though it fell back below US$64. Producers including BP, Shell and Chrysaor said they had closed down oil fields in response.

The International Energy Agency, which co-ordinates the release of oil from strategic stocks in the case of supply disruptions, said it was “monitoring the situation closely”.

Other local infrastructure problems

Further pressure on the GB system came with the news also on Tuesday that a power failure at the giant Troll gas field was going to cut production by over 30 mcm, while scheduled maintenance at the Kollsnes processing plant was also ongoing, and production was also down to about 40% of its usual output at the aging Morecombe Bay field.

At the same time, compressor problems caused a brief interruption on the BBL interconnector with the Netherlands.

The net effect of all of these issues was a spike in wholesale gas prices – NBP within-day gas prices jumped from 64p/th to 99p/th in the morning before falling to 73p/th at the close.

Fire at a major European transit point adds to the disruption

On Tuesday there was an explosion at the major European gas hub at Baumgarten in Austria, a major transit point for Russian gas coming into Europe. Footage on social and other media showed a column of fire rising above the site following an explosion at 9am local time. A wide area was cordoned off and some 250 firefighters were called to tackle blaze which was finally put out by Tuesday afternoon. The police and site operator, Gas Connect Austria, said they believed a technical fault was to blame for the incident in which one person lost their life and 21 were injured.

According to Platts Analytics, supplies at the Italian boarder were cut during the incident causing prices at PSV to almost double overnight from EUR 23.70 /MWh on Monday to EUR 45 /MWh on Tuesday, peaking at EUR 75 /MWh. 108 mcm of Russian gas was nominated for delivery to Italy via Austria on Tuesday, while German deliveries via the route were nominated at 8 mcm.

Italy declared a state of emergency on the back of the news, giving the government the right to invoke extraordinary measures, including allowing coal and oil power plants to operate at full capacity. As it happened, the damage caused to the infrastructure was fairly limited and supplies were restored to the country later on Tuesday.

Political response is unsurprisingly unrealistic

Politicians immediately began putting pressure on energy suppliers not to pass price rises on to consumers, citing long-term purchase strategies.

“Passing on price rises to the consumer would be totally unfair because it’s not their fault and this is nothing to do with them. The big energy companies buy their gas and oil about six months in advance, so there should be no need to increase bills. They should continue to honour their commitments to consumers. If they pass this on to their customers, it would be a disgrace,”

– Ian Liddell-Grainger MP, member of the parliamentary business and energy select committee

Such statements add to a wider perception that energy companies profiteer at the expense of consumers. While it is true that many suppliers, particularly the Big 6, engage in forward hedging programmes, any persistent increases in prices will eventually need to be either absorbed by suppliers or passed on to consumers. Infrastructure problems are also not the fault of suppliers, and assuming their margins should fall as a result is not necessarily sustainable.

The risk that price rises are sustained is not remote. According to Oliver Sanderson, an analyst at Thomson Reuters, the “spectacular” confluence of problems could result in high prices for the rest of the winter.

“This isn’t just about where we’ll find the gas we need for today – it’s about where to find the gas we’ll need in January. If small suppliers haven’t bought energy in advance, and that is possible due to the sudden start of cold weather in the last few weeks, they could be in trouble.”

Of course, consumers would not benefit if competition is reduced by smaller suppliers going out of business as a result of higher market prices if they are unable to pass them on to their customers.

Can GB’s gas infrastructure cope?

System breakdowns are more common during harsh weather conditions, and this winter has got off to an unusually cold start, but last week’s issues raise some concerns over the resilience of the UK’s gas supplies. Britain has both less storage and fewer inter- connectors than its Continental neighbours, and it takes about two weeks for an LNG tanker to reach the country form Qatar.

Only one tanker, the Bu Samra, is confirmed as arriving this month, although, according to Bloomberg, the first tanker from Russia’s Yamal LNG plant may also head to Britain and could arrive in about five days.

The supply crisis in the UK may lead to more LNG imports from the US, according to Zach Allen, president of vessel-tracking company Pan Eurasian Enterprises. The addition of the Cove Point facility in Maryland, which is preparing to start production, would cut shipping times to Europe.

“The good news is Europe will not “freeze in the dark,” the bad news is keeping the lights and the heat on may not be pretty,”

– Zach Allen

The real question is, as always, how long will the higher prices persist. Previous analysis has suggested that the market is able to absorb infrastructure disruptions and cold weather, but the topic of energy prices is currently high on the political agenda. Suppliers will be under pressure to avoid increasing prices to consumers, so purchasing and hedging strategies need to be well chosen to avoid margin erosion.

In the event it seems that not only did the Christophe de Margerie discharge her inaugural Yamal LNG cargo at Grain on 28th/29th December according to AIS ship tracking, but she was followed by the Gaselys with a cargo from Sabine Pass discharged on the 30th, with the vessel remaining moored at Grain first for the New Year holiday and then because of bad weather (at least she has yet to move). What is slightly more puzzling is that there was apparently no movement of gas in or out of Grain on 27th December, and no sign of the Yamal cargo reducing the free ullage, yet storage was almost full after the Gaselys discharge.

https://www.nationalgrid.com/sites/default/files/documents/ST%2003.01.2018.xls

Curiouser and curiouser.