The UK gas market is facing unprecedented changes, with a conflation of declining North Sea production, threats to the UK’s gas storage capability, and of course, Brexit.

The UK gas market is facing unprecedented changes, with a conflation of declining North Sea production, threats to the UK’s gas storage capability, and of course, Brexit.

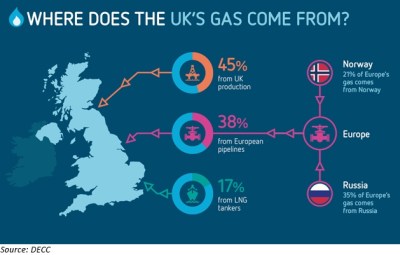

Historically, UK gas came almost entirely from domestic production, with a small amount of imports from Norway, however over the past decade the UK’s North Sea output has been steadily falling, and supplemented by increasing imports.

In terms of consumption, the recent trend has seen an increase in gas used for electricity generation on the back of the higher Carbon Price Floor which has driven a switch away from coal to gas. In fact, this is part of a wider pan-European trend driven by higher coal prices, but the CPF strengthens the effect in the UK, leading to a significant increase in price volatility at the NBP.

Shifting sands in the global gas market

According to this excellent paper by my old colleague, Thierry Bros, there are a number of revolutionary themes driving global energy markets:

#1: One the supply side – US shale and renewables

The development of unconventional gas (and oil) resources has significantly changed the arithmetic around global reserves, and is likely to turn the US, a major energy importer into a net exporter. Other countries are also developing shale resources, leading to significant diversification of global energy supplies. At the same time, renewable energy generation has exploded onto the scene – between 2005-2015 global renewable energy production grew by 16% pa when total primary consumption grew only by 2% pa. 2015 was the first year on record in which additions of renewable power generation capacity were higher than those for thermal capacity.

#2: Efficiency gains drive down consumption

From 2006 the European economy has been able to achieve growth while using less energy. This decoupling between economic and energy demand is significant and unprecedented – previously economic growth was always accompanied by higher energy use. Europe is now definitively past its peak energy demand and the trend is set to continue with the 2030 EU climate and energy roadmap. Other regions are likely to follow suit, with China seeing declining energy use per unit of GDP.

#3: Energy storage threatens further disruption

Developments in electricity storage technology have the potential to smooth out the effects of intermittency that arise from renewable electricity generation. Local and domestic storage technologies are supporting the trend of decentralisation of energy systems, changing the fundamental basis on which electricity is generated and delivered.

Each of these has impacts that can be seen in the UK gas market.

Plenty of LNG is available….

According to Timera Energy, although the volume of US LNG that has landed in Europe so far has been modest at just 17% of the total, US shipments are being priced, optimised and hedged based on NBP/TTF price signals, since Europe is seen as the market of last resort providing the benchmark against which regional spot prices in Asia and Latin America are determined. After Latin America, Europe is the next cheapest destination for US exports based on shipping costs…as US exports increase, significant volumes are likely to land in Europe.

The increasing amount of US gas coming to Europe is likely to see US Henry Hub prices start to influence European gas prices, as Henry Hub prices drive the cost structure of US gas exports. As more US export terminals come online, the global gas glut will increase, leading to growing convergence between US and European prices.

Timera expects that the LNG glut will continue for the next 3 – 5 years, but that tightness may return thereafter unless new LNG supply projects take their Financial Investment Decisions (FIDs) soon.

…undermining the economics of gas storage

The glut in LNG supply globally is helping to undermine the economics of gas storage in Europe. Reuters reported last week that utilities across Europe are seeing losses and multi-billion euro write-downs on their storage businesses, leading to 5% of facilities closing this decade and more at risk of closure.

In the UK, Centrica has reported its first ever loss in its storage business and a £176 million impairment, as operational issues have led to restricted use of Rough, which some analysts are predicting will cost the company at least another £100 million before the facility finally closes. Meanwhile SSE took a £151 million impairment on its storage business and has mothballed a third of the capacity at Hornsea.

The easy availability of LNG and the increase in pipeline imports from Norway since the opening of the Langeled pipeline mean that government intervention in the UK storage market remains unlikely.

Implications of Brexit

The immediate impact of the Brexit vote on the UK gas market has been to make European gas imports more expensive due to the devaluation of the pound. Looking forwards, the prospect of tariffs on gas imported via the IUK and BBL pipelines could also inflate costs, however here the issue of Ireland gives the UK a stronger negotiating position – Ireland remains a member of the EU but is almost entirely dependent on gas delivered by or transited through the UK.

Attempts by the EU to impose tariffs on gas coming to the UK via IUK and BBL would be likely to have an impact on supplies to Ireland, which could act as an incentive for tariffs to be held to a minimum. The relationship with Norway will continue to be key, and ongoing access to Norwegian gas on acceptable economic terms will be vital.

The post Brexit energy relationship with the EU may change the way the UK government looks at storage since its implied access to European storage facilities may be curtailed, however, other outcomes are possible such as a direct pipeline link with Russia.

The UK gas market is facing interesting times. Brexit, the decline in North Sea production and the collapse of gas storage economics all point to a shift away from traditional market mechanics. The ongoing global oversupply of gas, and the spare capacity in the UK’s LNG terminals combined with good pipeline connections particularly to Norwegian producing fields more than mitigates these risks in the short term, however, a dependency on imports leaves the UK vulnerable to external pricing pressures. In a post Brexit, post North Sea and post Rough world, the UK’s “energy diplomacy” will be more important than ever before.

Kathryn,

Your article provides a good summary of the UK’s forthcoming energy security challenges. In a time of expected LNG plenty and with lots of pipeline connections from the Continent it would be easy to be complacent about supplies. However the UK has a couple of other challenges to add to the ones you identify. Firstly the UK adds an extra charge to LNG imports that is absent from the Continent (variable transmission entry fees). Secondly there is hardly any capacity booked in the import pipelines from 2019 (IUK and BBL), leading to questions of their continued viability. The first challenge will probably get addressed in 2019 as part of National Grid’s gas transmission charging review. The second is a much bigger challenge. Neither pipeline sold any annual capacity in their recent auctions. The merchant pipeline business model is not one that can be relied on to provide energy security. Interesting times indeed.

Great points Mark, thanks for the comment…..I agree it will be very interesting to see what happens with the interconnectors….